View News

Union Budget 2026–27: A Comprehensive Legal, Economic And Policy Analysis

Union Budget 2026–27: A Comprehensive Legal, Economic And Policy Analysis

Introduction: Budget 2026–27 in Context

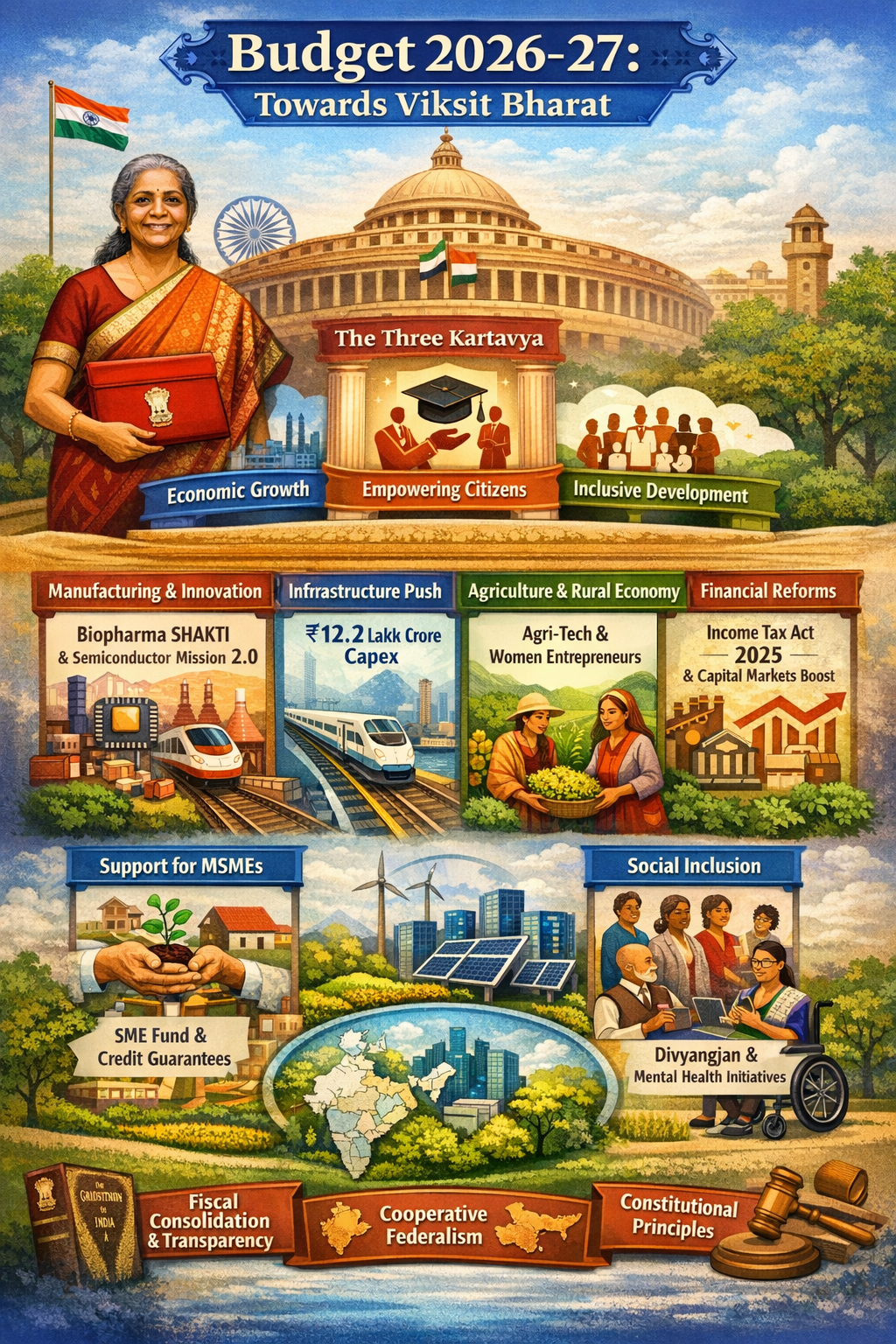

The Union Budget 2026–27, presented by the Hon’ble Finance Minister Smt. Nirmala Sitharaman, represents a calibrated continuation of India’s long-term reform trajectory while simultaneously responding to emerging global and domestic challenges. Framed in a period marked by disrupted global supply chains, rapid technological transitions, climate and energy pressures, and geopolitical uncertainty, the Budget seeks to balance growth imperatives with inclusion and fiscal prudence. It aligns closely with the Government’s stated vision of Viksit Bharat, which emphasises productivity-led growth, capacity creation, institutional strengthening, and equitable access to economic opportunities.

From a constitutional standpoint, the Union Budget draws its authority and structure from Article 112 of the Constitution of India, which mandates the presentation of the Annual Financial Statement, read together with Article 266 governing the Consolidated Fund of India. The Budget assumes added constitutional significance when viewed in light of Article 281, which requires the President to place before Parliament the recommendations of the Finance Commission along with an explanatory memorandum. Budget 2026–27 consciously operationalises this mandate by reflecting vertical and horizontal devolution principles recommended by the Finance Commission, thereby reinforcing cooperative federalism, fiscal transparency, and accountability in Centre–State financial relations.

Unlike earlier budgets that were largely shaped by crisis response, pandemic recovery, or inflation containment, the present Budget reflects confidence in India’s macroeconomic fundamentals. Sustained growth of approximately seven per cent, moderate inflation, improving external balances, and a steady path of fiscal consolidation provide the backdrop for a forward-looking policy framework that combines structural reforms, targeted sectoral interventions, and legal rationalisation.

The Three Kartavya Framework: Policy Architecture of the Budget

The policy architecture of Budget 2026–27 is organised around three articulated kartavya, which together define the Government’s economic philosophy for the coming decade. These kartavya serve not merely as thematic pillars but as guiding principles shaping expenditure priorities, regulatory reforms, and institutional interventions.

The first kartavya focuses on accelerating and sustaining economic growth through enhanced productivity, competitiveness, and resilience. This objective is pursued through targeted interventions in manufacturing, infrastructure creation, energy security, logistics, and urban development, recognising that sustained growth must be anchored in real-sector capacity expansion.

The second kartavya seeks to fulfil the aspirations of citizens by investing in human capital and institutional capability. Greater emphasis is placed on services, education, healthcare, tourism, and emerging professions, reflecting the transition of the Indian economy towards knowledge-intensive and service-led growth.

The third kartavya aligns with the constitutional vision of Sabka Saath, Sabka Vikas, ensuring that the benefits of growth extend to farmers, women, Divyangjan, vulnerable communities, and geographically lagging regions, particularly the Purvodaya States and the North-Eastern Region. This inclusive orientation reinforces the distributive and welfare objectives embedded in India’s constitutional framework.

Manufacturing-Led Growth: Strategic and Frontier Sectors

Manufacturing occupies a central position in the growth strategy articulated in Budget 2026–27, with a deliberate focus on both frontier technologies and labour-intensive traditional sectors. The approach recognises manufacturing not only as a source of output and exports but also as a generator of employment and technological capability.

Biopharma SHAKTI and Healthcare Manufacturing

The Budget acknowledges the structural shift in India’s disease profile towards non-communicable diseases and the strategic importance of biologics and biosimilars in modern healthcare. The proposed Biopharma SHAKTI initiative, with an outlay of Rs 10,000 crore over five years, aims to establish a comprehensive domestic ecosystem for biologic medicines. This includes upgrading National Institutes of Pharmaceutical Education and Research, expanding accredited clinical trial networks, and strengthening regulatory capacity within the Central Drugs Standard Control Organisation.

From a legal perspective, these measures operate within the framework of the Drugs and Cosmetics Act, 1940, while seeking to reduce regulatory timelines without compromising safety or quality standards. For instance, faster and more predictable approvals for biosimilars can significantly lower treatment costs for chronic illnesses such as cancer and diabetes, thereby improving healthcare accessibility while supporting domestic manufacturing.

Semiconductors, Electronics and Critical Minerals

Building on earlier initiatives, the India Semiconductor Mission 2.0 expands its focus beyond fabrication to encompass equipment, materials, and end-to-end indigenous intellectual property development. This strategic shift responds to vulnerabilities exposed by global semiconductor shortages and seeks to reduce long-term import dependence.

Parallel emphasis on electronics component manufacturing and the creation of Rare Earth Corridors in mineral-rich States supports India’s clean energy and high-technology ambitions. These measures are underpinned by customs duty rationalisation under the Customs Act, 1962, and investment facilitation mechanisms under FEMA regulations, ensuring that industrial policy is supported by a coherent legal framework.

Capital Goods, Textiles and Traditional Industries

The Budget balances advanced manufacturing with labour-intensive sectors to ensure broad-based employment generation. Schemes for hi-tech tool rooms, container manufacturing, and construction equipment aim to improve industrial productivity and infrastructure readiness.

In textiles, integrated programmes covering fibres, handlooms, technical textiles, and skilling adopt a cluster-based development approach. Modernisation of a traditional textile cluster through capital support and common testing facilities, for example, can directly enhance export competitiveness while preserving livelihoods, demonstrating the inclusive potential of industrial policy.

MSMEs as Growth Champions

Micro, Small and Medium Enterprises are positioned as future growth champions through a combination of equity infusion, liquidity support, and professional assistance. The proposed SME Growth Fund and the top-up to the Self-Reliant India Fund provide risk capital aligned with the objectives of the MSMED Act, 2006.

Judicially, targeted MSME support finds constitutional validation in Shree Meenakshi Mills Ltd. v. Union of India, where the Supreme Court recognised small enterprises as a distinct economic class warranting differential treatment. Liquidity measures, including mandatory use of TReDS by CPSEs and enhanced credit guarantee support, address chronic receivables challenges. Invoice discounting through TReDS, for instance, allows MSMEs to convert delayed government payments into immediate working capital, improving financial stability.

Professional support through accredited ‘Corporate Mitras’, leveraging institutions such as ICAI, ICSI and ICMAI, reduces compliance burdens for MSMEs, particularly in Tier II and Tier III cities, thereby promoting formalisation and sustainability.

Infrastructure and Urban Development

Public capital expenditure is increased to Rs. 12.2 lakh crore, reaffirming infrastructure as a key growth multiplier. The Supreme Court has consistently recognised infrastructure investment as a legitimate instrument of economic policy, observing in Bharti Airtel Ltd. v. Union of India that fiscal and economic choices warrant judicial deference unless manifestly arbitrary.

The proposed Infrastructure Risk Guarantee Fund addresses construction-phase risks that often deter private investment. Investments in dedicated freight corridors, inland waterways, coastal shipping, and seaplane connectivity aim to reduce logistics costs and promote sustainable transport, operating within statutory frameworks such as the National Infrastructure Pipeline and the Inland Waterways Act, 2016.

The introduction of City Economic Regions marks a conceptual shift from city-centric planning to regional economic clusters, supported by reform-linked financing and high-speed rail connectivity, thereby integrating urban growth with regional development.

Financial Sector and Capital Markets Reforms

The proposal to constitute a High-Level Committee on Banking for Viksit Bharat reflects confidence in the resilience of the financial system while acknowledging the need for future-ready reforms. Measures to deepen corporate bond markets through market-making frameworks, derivatives, and incentives for municipal bonds aim to diversify long-term financing sources.

These initiatives strengthen the legal and regulatory ecosystem under SEBI regulations and municipal finance frameworks, facilitating infrastructure financing and reducing reliance on bank credit.

Services Sector and Human Capital Development

The Budget renews emphasis on services as a driver of employment, exports, and value creation. Tourism, healthcare, education, design, AVGC, and allied services receive targeted support to create structured career pathways.

From a constitutional perspective, service enterprises also enjoy protection under Article 19(1)(g), subject to reasonable restrictions, as consistently interpreted by courts. The proposed Education-to-Employment Standing Committee seeks to align educational outcomes with labour market needs. Training allied health professionals under NSQF-aligned programmes, for example, directly strengthens healthcare delivery while generating employment.

Investments in education infrastructure, including university townships, girls’ hostels, and advanced research facilities, reinforce inclusive and research-oriented growth.

Agriculture, Rural Economy and Women Entrepreneurship

The Budget prioritises income enhancement in agriculture through diversification into high-value crops, fisheries, and livestock-based value chains. This policy orientation recognises the structural limitations of traditional cereal-centric agriculture and seeks to stabilise farmer incomes by integrating agriculture with processing, logistics, and export markets. The approach mirrors the judicial reasoning in State of Karnataka v. Shri Ranganatha Reddy, where the Supreme Court upheld State-led economic interventions designed to ensure equitable distribution of resources and to correct historical imbalances in agrarian economies.

Targeted schemes for coconut, cashew, cocoa, bamboo, and sandalwood reflect a commodity-specific strategy aligned with regional agro-climatic advantages. For instance, enhanced support for coconut value chains in coastal States facilitates integrated processing units, thereby allowing farmers to move up the value curve rather than remain dependent on volatile raw produce prices. These measures operate within the broader framework of agricultural marketing reforms and export facilitation policies.

The Bharat-VISTAAR AI platform represents a significant institutional innovation by integrating AgriStack datasets with real-time advisory services. By leveraging artificial intelligence for crop planning, pest management, and market linkage, the platform exemplifies technology-enabled governance in agriculture. Hypothetically, a small farmer using AI-based advisories to shift from low-margin crops to high-value horticulture directly benefits from informed decision-making backed by State-supported data infrastructure.

Women entrepreneurship in rural areas is strengthened through expansion of self-help group ecosystems and SHE-Marts. These initiatives link credit access with assured market platforms, thereby addressing the long-standing issue of demand-side constraints faced by women-led micro enterprises. Such measures also align with constitutional mandates under Articles 14 and 15, which permit affirmative action to address structural disadvantages.

Social Inclusion: Divyangjan, Mental Health and Regional Equity

The Budget advances a rights-based approach to inclusion by focusing on Divyangjan, mental health, and geographically lagging regions. Targeted skilling programmes and assistive device initiatives reinforce statutory guarantees under the Rights of Persons with Disabilities Act, 2016, by moving beyond welfare towards economic participation. For example, customised skill development combined with assistive technology enables persons with disabilities to integrate into formal employment and entrepreneurship ecosystems.

Mental health infrastructure receives focused attention through the expansion of institutions such as NIMHANS-2 and trauma care centres. This reflects judicial recognition that the right to health forms an integral part of Article 21 of the Constitution. Strengthening mental healthcare capacity therefore carries both social and constitutional significance.

Region-specific interventions for Purvodaya States and the North-Eastern Region integrate infrastructure development with tourism-led growth, including Buddhist circuits and connectivity projects. These measures seek to correct regional disparities while leveraging cultural and ecological assets for sustainable development.

Fiscal Consolidation and Constitutional Framework

The Budget reaffirms commitment to fiscal discipline through a calibrated reduction in fiscal deficit and a declining debt-to-GDP trajectory. These targets are consistent with the Fiscal Responsibility and Budget Management framework, which seeks to balance growth imperatives with inter-generational equity. Judicially, fiscal discipline has been recognised as an essential component of sound economic governance.

Acceptance of the 16th Finance Commission’s recommendations on vertical devolution underscores cooperative federalism as envisaged under Articles 280 and 281 of the Constitution. Article 281 assumes particular significance as it mandates transparency and parliamentary accountability in fiscal transfers between the Union and the States. By operationalising these recommendations through the Budget, the Government reinforces constitutional fidelity and fiscal transparency.

Direct Tax Reforms: Simplicity, Certainty and Trust

The introduction of the Income Tax Act, 2025 marks a structural shift towards simplified compliance, reduced litigation, and enhanced taxpayer trust. The reform is premised on the long-standing judicial principle that tax administration must balance revenue collection with fairness and certainty. This philosophy was articulated by the Supreme Court in CIT v. Reliance Petroproducts Pvt. Ltd., where it was held that a mere making of a claim, even if disallowed, does not automatically invite penalty in the absence of concealment or furnishing of inaccurate particulars.

Rationalisation of tax deduction at source and tax collection at source provisions addresses procedural excesses that had led to disproportionate compliance burdens. In Hindustan Coca Cola Beverages Pvt. Ltd. v. CIT, the Supreme Court clarified that once tax has been paid by the recipient, the payer cannot be subjected to double recovery. The streamlined TDS–TCS framework reflects this jurisprudential clarity and is likely to reduce avoidable disputes.

Recalibration of the Liberalised Remittance Scheme, including rationalised TCS rates and clearer exclusions, improves cash-flow efficiency and aligns tax procedure with economic reality. This approach resonates with Azadi Bachao Andolan v. Union of India, where the Court emphasised that legitimate tax planning within the law should not be viewed with suspicion. Hypothetically, an individual remitting funds for overseas education benefits from reduced upfront tax blockage without compromising revenue interests.

The express exemption of interest on motor accident compensation addresses prior inconsistencies in tax treatment. Courts have traditionally characterised such receipts as compensatory rather than income in nature. Statutory recognition of this principle reduces litigation and reinforces substance-based taxation.

A notable shift under the new law is the decriminalisation of minor and technical defaults. In Om Prakash v. Union of India, the Supreme Court cautioned against routine invocation of prosecution provisions where civil remedies suffice. By narrowing the scope of criminal liability, the law restores proportionality in enforcement.

International taxation reforms, including expanded safe harbour rules, enhance certainty for sectors such as information technology and data centres. In Vodafone International Holdings BV v. Union of India, the Supreme Court underscored that tax certainty is integral to a stable investment climate. Predictable tax outcomes reduce litigation risk and strengthen India’s attractiveness as an investment destination.

Indirect Tax and Customs Reforms

Customs duty rationalisation and removal of obsolete exemptions support domestic manufacturing and export competitiveness. In Kasinka Trading v. Union of India, the Supreme Court upheld the sovereign authority of the State to modify fiscal exemptions in pursuit of economic policy objectives, subject to non-arbitrariness. Simplified customs procedures and trust-based digital systems reduce transaction costs and improve trade facilitation.

Conclusion: Towards Viksit Bharat

The Union Budget 2026–27 represents a transition from recovery-driven policymaking to consolidation and long-term transformation. Its defining strength lies in integrating economic ambition with constitutional discipline, legal certainty, and institutional reform. By grounding fiscal measures in judicial principles and cooperative federalism, the Budget functions not merely as a financial statement but as a constitutional instrument advancing the vision of Viksit Bharat.

Frequently Asked Questions (FAQs)

The Budget differs from earlier budgets by prioritising structural reforms and fiscal consolidation over short-term stimulus measures.

The Income Tax Act, 2025 is significant as it simplifies compliance, reduces litigation, and fosters taxpayer trust through clarity and automation.

MSMEs benefit through access to equity funds, liquidity support, credit guarantees, and affordable professional compliance mechanisms.

Infrastructure initiatives operate within established legal frameworks including the FRBM Act, Customs Act, Inland Waterways Act, and SEBI regulations.

Inclusion is promoted through targeted interventions for farmers, women, Divyangjan, vulnerable groups, and region-specific development programmes.

Gist of Union Budget 2026–27 (Tabular Summary)

|

Area |

Core Focus in Budget 2026–27 |

Legal / Constitutional Basis |

Intended Outcome |

|

Constitutional Framework |

Fiscal transparency and Centre–State devolution |

Articles 112, 266, 280 & 281 |

Strengthened cooperative federalism |

|

Economic Strategy |

Productivity-led, investment-driven growth |

Judicial deference to fiscal policy |

Sustained macroeconomic stability |

|

Manufacturing |

Biopharma, semiconductors, electronics, textiles |

Drugs & Cosmetics Act, Customs Act, FEMA |

Import substitution and employment |

|

MSMEs |

Equity funds, TReDS liquidity, compliance support |

MSMED Act, 2006 |

Improved cash flow and formalisation |

|

Infrastructure |

High capital expenditure, logistics, urban clusters |

FRBM Act, Inland Waterways Act |

Lower logistics costs, private investment |

|

Financial Sector |

Bond market deepening, banking reforms |

SEBI regulations |

Diversified long-term financing |

|

Services & Human Capital |

Education–employment linkage, tourism, healthcare |

Article 19(1)(g) |

Service-led employment growth |

|

Agriculture & Rural Economy |

Crop diversification, AI-based advisories |

Agrarian reform jurisprudence |

Higher farmer incomes |

|

Social Inclusion |

Divyangjan, mental health, regional equity |

Article 21, RPwD Act, 2016 |

Rights-based inclusion |

|

Direct Tax Reforms |

Income Tax Act, 2025, decriminalisation |

Supreme Court tax jurisprudence |

Reduced litigation, tax certainty |

|

Indirect Taxes |

Customs duty rationalisation |

Customs Act; Kasinka Trading case |

Trade facilitation |

|

Fiscal Discipline |

Deficit and debt reduction |

FRBM framework |

Inter-generational equity |

Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc

LegalMantra.net team