View News

UNDERSTANDING DEPOSITS

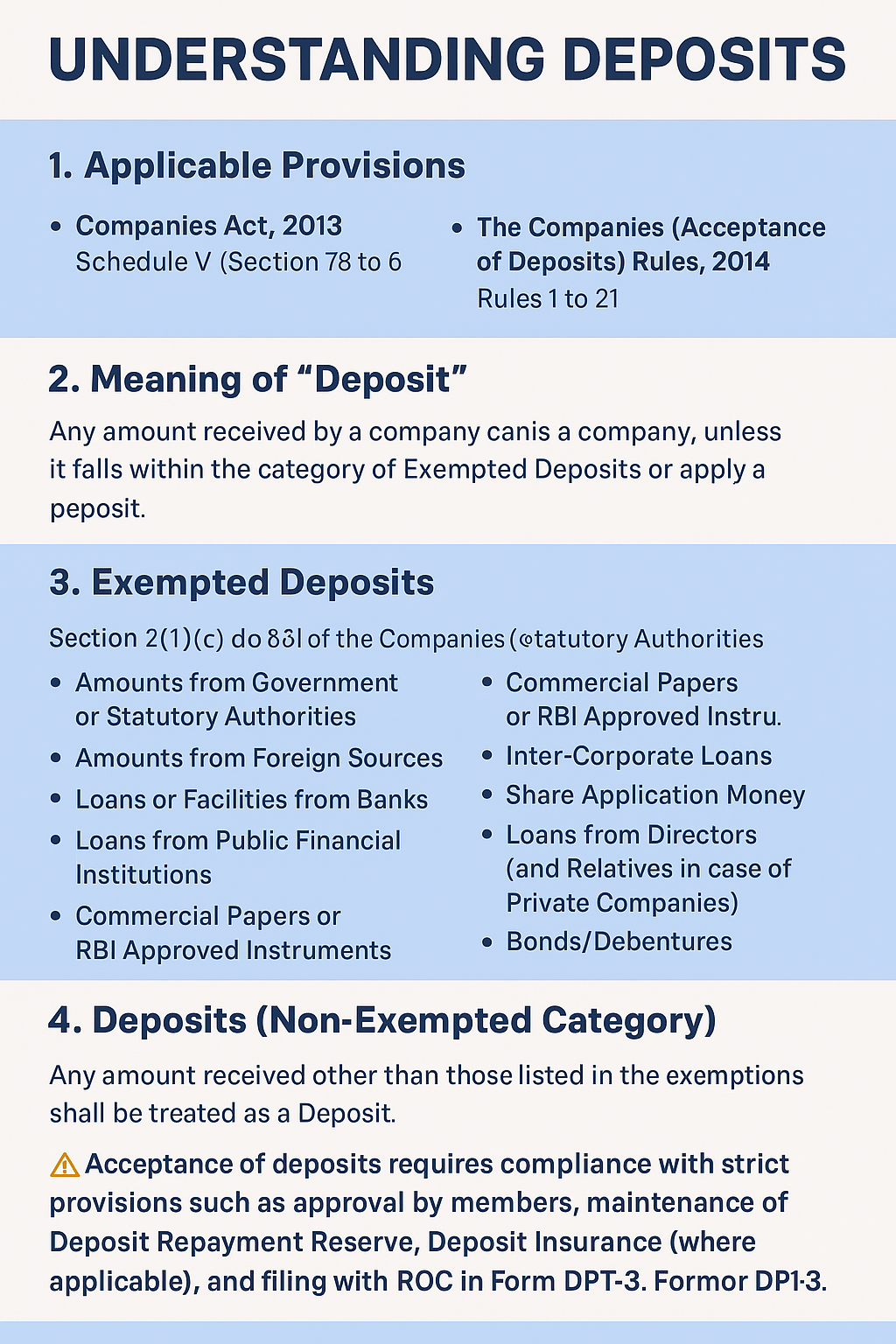

UNDERSTANDING DEPOSITS

(With Reference to the Companies Act, 2013 & The Companies (Acceptance of Deposits) Rules, 2014)

1. Applicable Provisions

-

Companies Act, 2013

Sections 73 to 76A, read with Schedule V -

The Companies (Acceptance of Deposits) Rules, 2014

Rules 1 to 21

2. Meaning of “Deposit”

Broadly, any amount received by a company is treated as a Deposit unless it specifically falls within the category of Exempted Deposits.

Thus, before classifying an amount as “Deposit,” one must first verify whether it qualifies as an Exempted Deposit under the law.

3. Exempted Deposits

As per Section 2(1)(c) of the Companies (Acceptance of Deposits) Rules, 2014, certain categories of receipts are not considered deposits. A detailed list is as follows:

3.1. Amounts Received from Government or Statutory Authorities

-

From Central or State Government, Statutory Authorities, or Local Authorities, or any amount guaranteed by the Government.

3.2. Amounts Received from Foreign Sources

-

From foreign governments, banks, multilateral institutions, foreign bodies corporate, collaborators, foreign citizens, or persons resident outside India.

3.3. Loans/Facilities from Banks

-

Any loan or credit facility from:

-

Scheduled Commercial Banks (including SBI and its subsidiaries)

-

Cooperative banks

-

Institutions notified under the Banking Regulation Act.

-

3.4. Loans from Public Financial Institutions (PFIs)

-

Financial assistance from PFIs, Insurance Companies, or Regional Financial Institutions.

3.5. Commercial Papers or RBI Approved Instruments

3.6. Inter-Corporate Loans

-

Any loan or deposit received from another company.

3.7. Share Application Money

-

Money received against issue of shares (pending allotment) provided:

-

Allotment is made within 60 days; OR

-

If not allotted, refund is made within 15 days after expiry of 60 days.

-

If not refunded ? treated as deposit.

-

3.8. Loans from Directors (and Relatives in case of Private Companies)

-

Exempted subject to declaration of source being filed.

3.9. Bonds/Debentures

-

Bonds or debentures secured by charge on tangible assets, or compulsorily convertible into shares within 10 years.

-

Value of secured bonds/debentures cannot exceed the market value of assets (certified by a registered valuer).

3.10. Listed Non-Convertible Debentures (NCDs)

-

Provided they are listed on a recognized stock exchange.

3.11. Employee Security Deposits

-

Non-interest bearing deposits from employees, not exceeding annual salary.

3.12. Trust Money

-

Non-interest-bearing money held in trust.

3.13. Business-Related Advances

Money received in the ordinary course of business, including:

-

Advance for supply of goods/services (must be adjusted within 365 days).

-

Advance against immovable property under agreement.

-

Security deposit for performance of contract.

-

Advance under long-term projects for supply of capital goods.

-

Advance for warranty/maintenance (? 5 years or business practice period).

-

Advance allowed by sectoral regulators.

-

Subscription for publications (print/electronic).

3.14. Promoter Loans (as per lender’s stipulation)

-

Unsecured loans brought in by promoters (or relatives) to meet financial institution/bank requirements.

-

Exemption is valid till the institutional loan is repaid.

3.15. Nidhi Company Deposits

-

Deposits accepted as per Section 406.

4. Deposits (Non-Exempted Category)

Any amount received other than those listed above shall be treated as a Deposit.

Implication:

Acceptance of deposits requires compliance with strict provisions such as:

-

Approval by members,

-

Maintenance of Deposit Repayment Reserve,

-

Deposit Insurance (where applicable), and

-

Filing with ROC in Form DPT-3.

5. Filing of Form DPT-3

Every company (other than exempted classes like Government companies, NBFCs, and Housing Finance Companies) must file Form DPT-3 annually, reporting details of:

-

Deposits,

-

Particulars of transactions not considered deposits (exempted category).

5.1. Practical Aspects & Common Issues

(i) Loan Facility through Overdraft (OD Limit)

-

OD balances fluctuate daily.

-

Reporting format requires:

Opening Balance + Additions – Repayments + Adjustments = Closing Balance. -

Practically, exact tracking is difficult ? Companies often report closing balance.

(ii) Opening Balance Figures

-

DPT-3 is filed by 30th June based on provisional accounts (before audit).

-

Opening balance for a year = Closing balance of previous audited accounts.

-

Differences may arise due to audit adjustments.

(iii) Customer Advances

-

Advances must be adjusted within 365 days; else, treated as deposits.

-

Cannot be shown in ageing > 1 year (unless litigation pending).

(iv) Loans from Directors

-

Private Companies: Loan from directors/relatives = Exempt (with declaration).

-

Public Companies: Only directors’ loans are exempt (with declaration).

(v) Ageing of Loans

Loans must be shown under:

-

1 year

-

1 year but ? 3 years

-

3 years

(vi) Loan from NBFCs

-

To be disclosed under inter-corporate deposits.

(vii) Debentures

-

Exempt only if:

-

Secured by charge on assets, OR

-

Compulsorily Convertible within 10 years, OR

-

Listed NCDs (unsecured but listed).

-

6. Key Takeaways

-

Step 1: Verify nature of every liability Exempted or Deposit.

-

Step 2: Exempted deposits must still be disclosed in DPT-3.

-

Step 3: Deposits require strict compliance; hence companies should carefully structure funding to fall under “exempted” categories wherever possible.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc

Anshul Goel

LegalMantra.net Team