View News

SEBI Structural Push Towards Seamless Dematerialisation and Resolution of Legacy Physical Holdings

SEBI’s Structural Push Towards Seamless Dematerialisation and Resolution of Legacy Physical Holdings

The Securities and Exchange Board of India (SEBI) has in recent years progressively aligned market infrastructure reforms with the twin objectives of ease of doing investment and ease of doing business. In continuation of this regulatory philosophy, two recent circulars addressing dematerialisation and legacy physical securities mark a significant structural shift. While at first glance these changes may appear operational or procedural in nature, they in fact reflect a deeper attempt to remove friction points embedded in legacy processes, reduce manual intervention, and enhance systemic efficiency across the capital market ecosystem.

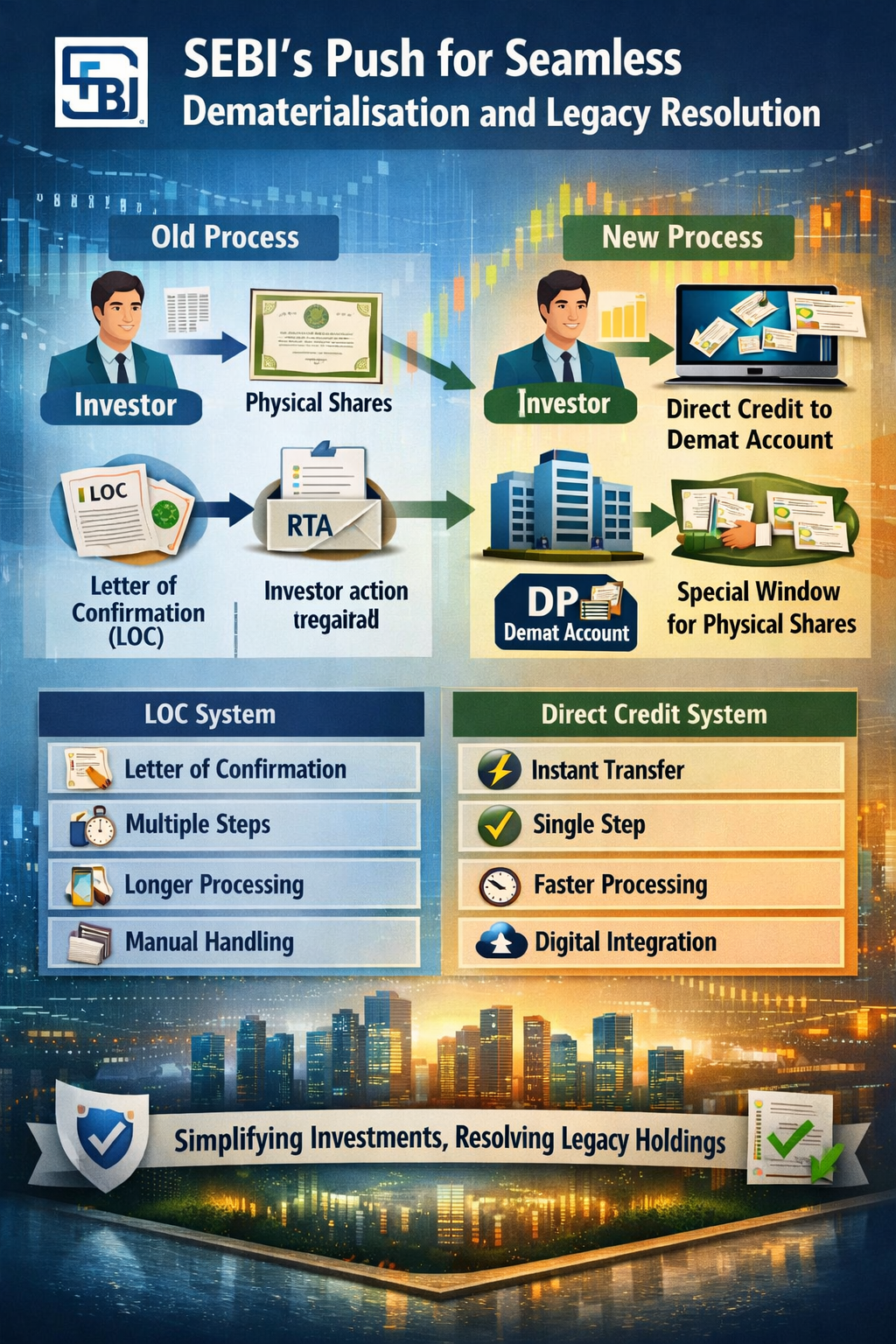

These measures specifically address two long-standing operational bottlenecks: first, the removal of the requirement of issuing Letters of Confirmation (LOC) and enabling direct credit of securities into demat accounts; and second, the introduction of a special window for transfer and dematerialisation of physical securities that have remained unresolved for years. Together, these changes recalibrate the interface between investors, Registrars and Transfer Agents (RTAs), depositories, and listed entities.

Historical Context: The Gradual Phasing Out of Physical Securities

India’s capital markets transitioned toward compulsory dematerialisation in phases, with the establishment of depositories such as National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL) fundamentally transforming securities holding patterns. Over time, regulatory mandates restricted transfer of securities in physical mode, and demat became the default holding format for listed securities.

However, despite mandatory dematerialisation for transfer purposes, a significant volume of legacy physical securities remained in circulation. These included shares inherited through succession, shares pending transfer due to incomplete documentation, and certificates lying dormant due to investor inaction. To manage cases where physical certificates were reported lost or required revalidation, the system evolved the concept of the Letter of Confirmation (LOC). Under this process, after verification, the RTA would issue a LOC to the investor, who would then approach a depository participant (DP) to effect dematerialisation.

Although intended as a risk-control mechanism, the LOC framework introduced additional steps, increased paperwork, extended processing timelines, and often resulted in investor confusion. In practice, it created a dual-layer interaction—first with the RTA and then with the DP—thereby multiplying touchpoints.

Removal of the Letter of Confirmation Requirement: From Intermediated to Direct Credit

SEBI’s decision to do away with the requirement of issuing Letters of Confirmation represents a decisive simplification. Instead of issuing a LOC that requires the investor to initiate dematerialisation separately, the revised mechanism allows securities to be directly credited into the investor’s demat account upon completion of due verification.

This reform carries both procedural and structural significance. Procedurally, it removes duplication. Structurally, it shifts the responsibility of integration onto the system rather than the investor. The burden of process navigation is reduced, and the flow of securities becomes more seamless.

The comparative position before and after the reform may be understood as follows:

| Aspect | Earlier LOC-Based System | Revised Direct Credit System |

|---|---|---|

| Post-verification document | Letter of Confirmation issued | No LOC issued |

| Investor action required | Approach DP separately for demat | No additional investor action |

| Touchpoints | RTA + DP | Integrated process |

| Processing time | Extended due to dual step | Reduced |

| Risk of delay | High due to documentation gaps | Lower due to streamlined execution |

From an RTA perspective, this change enhances accountability while reducing redundancy. The RTA’s verification role continues, but the outcome becomes immediate and system-driven. This reduces instances of pending LOCs, unacted confirmations, and incomplete dematerialisation requests.

Special Window for Transfer and Dematerialisation of Physical Securities

The second reform addresses a deeper structural issue: unresolved physical holdings that have persisted for years due to regulatory changes, succession disputes, lost certificates, or procedural complications.

SEBI’s introduction of a special window for transfer and dematerialisation of physical securities signals regulatory recognition that legacy stock cannot be eliminated merely through prospective mandates. There must be a transitional compliance pathway to cleanse the system.

This window provides investors holding physical securities—subject to specified conditions—with an opportunity to regularise holdings and convert them into demat form within a defined framework. Importantly, this approach balances investor facilitation with safeguards against fraudulent claims.

The regulatory philosophy underlying this window rests on three pillars. First, market integrity demands that outstanding physical securities not remain indefinitely outside the electronic framework. Second, investor protection requires that genuine holders be given a structured opportunity to claim and dematerialise holdings. Third, operational efficiency improves when parallel physical and electronic records are consolidated into a single demat-centric ecosystem.

Operational Implications for RTAs and Listed Companies

For Registrars and Transfer Agents, these reforms recalibrate workflow design. Earlier, physical handling, verification, issuance of confirmation letters, and coordination with depository participants required segmented processing. The revised regime encourages system integration and digitised reconciliation.

Operationally, the following shifts are observable:

| Functional Area | Pre-Reform Position | Post-Reform Direction |

|---|---|---|

| Documentation Handling | Paper-heavy verification and dispatch | Digitised validation and system upload |

| Investor Communication | Multiple correspondences | Consolidated communication |

| Reconciliation | Manual follow-ups | Automated credit confirmation |

| Record Clean-up | Fragmented legacy records | Structured legacy resolution |

Listed companies also benefit from cleaner shareholding records. A higher proportion of dematerialised holdings enhances transparency, reduces risks of forgery or duplicate certificates, and improves corporate action execution efficiency, particularly for dividends, bonus issues, and rights entitlements.

Broader Market Infrastructure Impact

Beyond immediate procedural benefits, these reforms strengthen the integrity of India’s market infrastructure. The dematerialisation ecosystem functions optimally when securities are held electronically, traceable through depository systems, and reconciled in real time.

The elimination of LOC requirements reduces administrative latency. The special window addresses historical backlog. Together, they reduce systemic friction.

From an investor protection standpoint, the reforms minimise the risk of misplaced documents, forged transfers, and prolonged procedural uncertainty. From a compliance standpoint, they reduce grey areas that historically arose when physical certificates were subject to competing claims or incomplete records.

The reforms also align with India’s broader digitisation trajectory across financial services, including KYC integration, online grievance redressal mechanisms, and centralised record systems.

Regulatory Intent and Ease of Doing Investment

SEBI’s reform approach increasingly reflects a shift from rule-heavy compliance to process-optimised regulation. Ease of doing investment is not merely about disclosure relaxation or reduced filing requirements; it is equally about eliminating unnecessary procedural layers that discourage investor participation.

Similarly, ease of doing business for intermediaries such as RTAs lies in reducing duplicative steps and enabling system-driven workflows. By allowing direct credit and structured dematerialisation pathways, SEBI reduces friction without diluting safeguards.

This balance between facilitation and control is crucial. Simplification must not compromise verification standards. The revised framework appears to maintain due diligence while removing avoidable procedural duplication.

Conclusion: Incremental Reform with Structural Impact

Although the removal of the Letter of Confirmation requirement and the introduction of a special dematerialisation window may appear incremental in isolation, their cumulative effect is structural. They address legacy inefficiencies, reduce manual intervention, and align operational execution with digital infrastructure capabilities.

For RTAs, these changes signify an evolution from document-processing intermediaries to integrated system facilitators. For listed entities, they promise cleaner shareholding structures. For investors, they reduce uncertainty and procedural burden.

Market efficiency is not built solely through macro reforms; it is strengthened through refinement of execution processes. By targeting friction points in dematerialisation and legacy holdings, the Securities and Exchange Board of India has taken another step toward consolidating a more seamless, secure, and investor-friendly capital market ecosystem.

These reforms reaffirm that regulatory value is realised not merely in drafting circulars, but in ensuring that on-ground processes become simpler, faster, and more reliable.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc

Anshul Goel

LegalMantra.net team