View News

24 Sep 2019

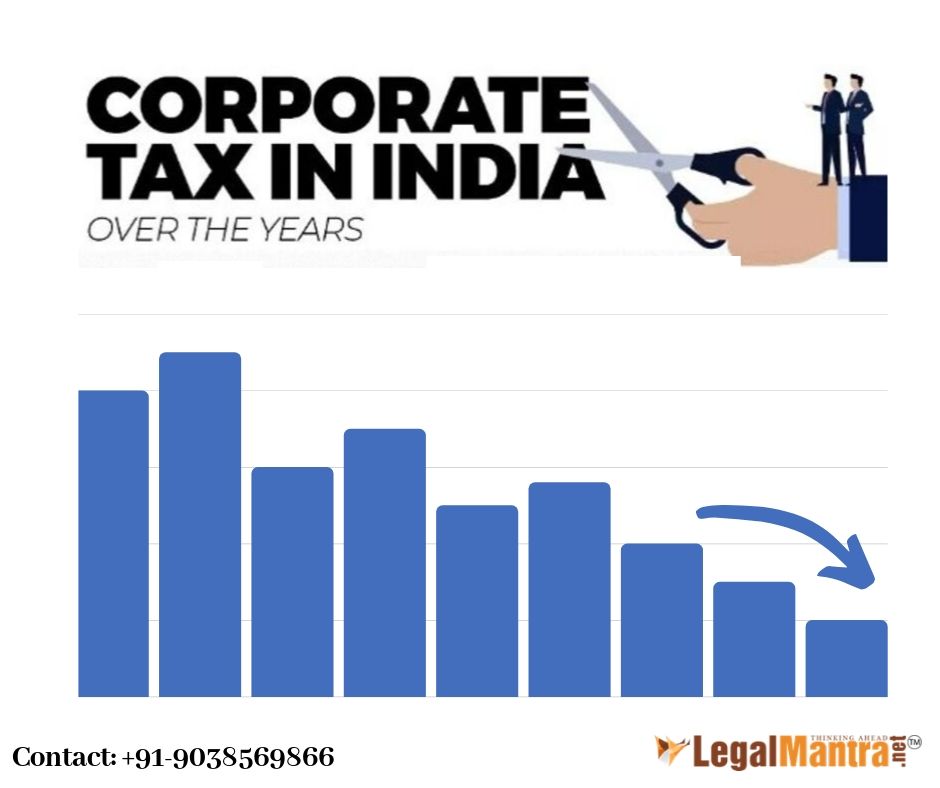

Simple Chart of Reduction in Corporate Tax Rates announced on 20th September

|

Sr. No. |

Applicable to |

New Tax Rate |

Effective Tax Rate |

MAT |

Rider |

Optional to whom |

|

1 |

Domestic Companies |

22% |

25.17% |

MAT shall not applicable |

Shall not avail any exemption & incentive like available u/s 10AA, Additional Depreciation, Chapter VI-A except 80JJAA |

Company enjoying tax holiday subject to MAT @ 15%. However after that they can opt for this. |

|

2 |

New Domestic Companies (Incorporated after 1st Oct, 19 but commences production before 31.03.2023) |

15% |

17.01% |

MAT shall not applicable |

Shall not avail any exemption & incentive like available u/s 10AA, Additional Depreciation, Chapter VI-A except 80JJAA |

NA |