View News

Loophole-in-RPT-definition

Loophole in RPT definition???

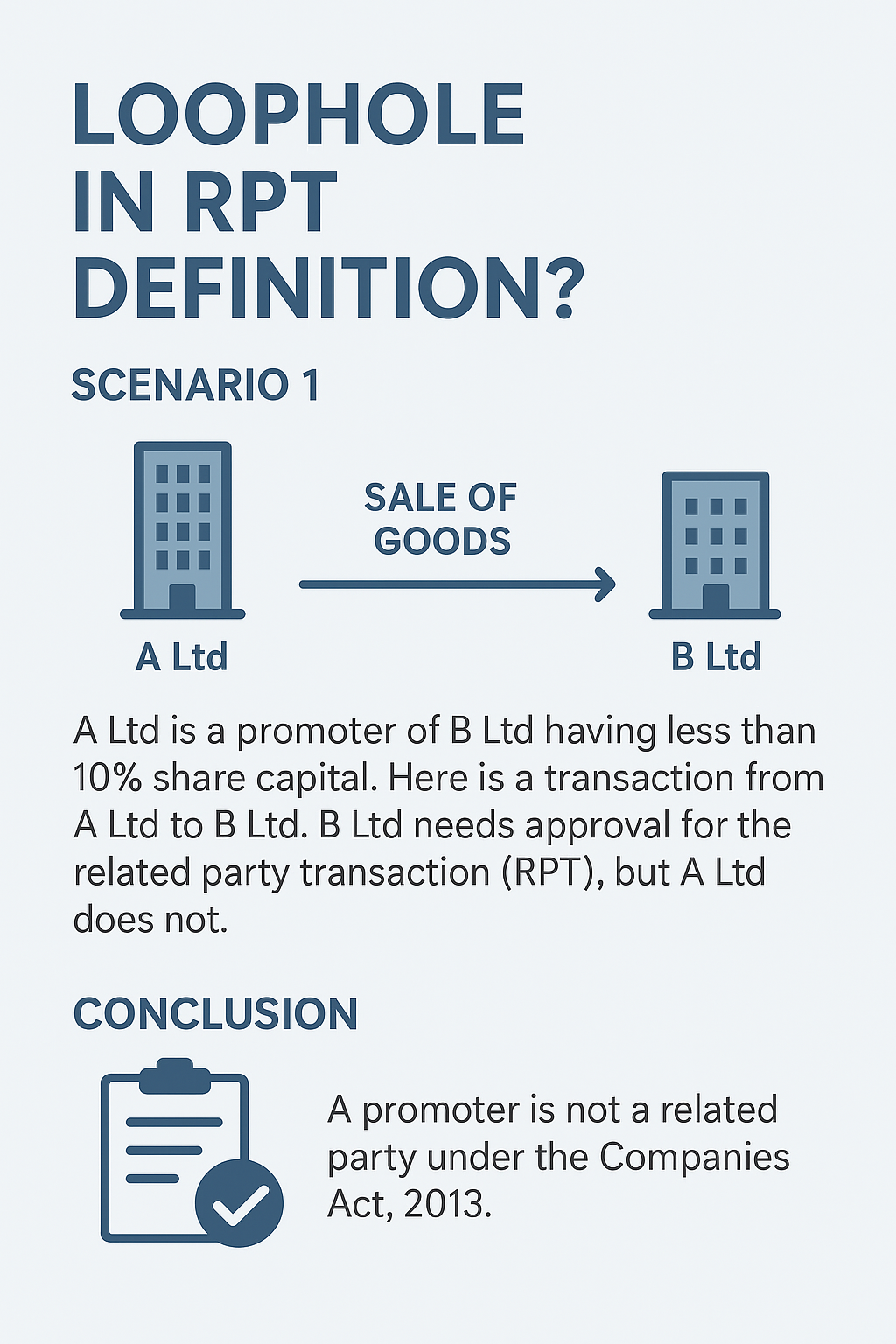

Scenario 1:

Let us assume A ltd and B ltd are 2 Listed Companies, where A ltd is Promoter of B ltd having less than 10% share capital. Now there is a transaction (Sale of Goods) from A ltd to B ltd. Here B ltd needs to get approval for Related Party Transaction from Audit Committee /Board /Shareholders based on limits prescribed under that Act. Whereas A ltd being a promoter to B ltd doesn’t need to get any approval for the sale.

Let’s see how.?

|

2 (zb) OF SEBI LODR REGULATIONS 2015 |

2 (76) of Companies Act,2013 |

|

“related party” means a related party as defined under sub-section (76) of section 2 of the Companies Act, 2013 or under the applicable accounting standards: [Provided that: (a) any person or entity forming a part of the promoter or promoter group of the listed entity; or (b) any person or any entity, holding equity shares: (i) of twenty per cent or more; Or (ii) of ten per cent or more, with effect from April 1, 2023; in the listed entity either directly or on a beneficial interest basis as provided under section 89 of the Companies Act, 2013, at any time, during the immediate preceding financial year; shall be deemed to be a related party:]

|

"related party", with reference to a company, means— (i) a director or his relative; (ii) a key managerial personnel or his relative; (iii) a firm, in which a director, manager or his relative is a partner; (iv) a private company in which a director or manager 1[or his relative] is a member or director; (v) a public company in which a director or manager is a director 2[and holds] along with his relatives, more than two per cent of its paid-up share capital; (vi) any body corporate whose Board of Directors, managing director or manager is accustomed to act in accordance with the advice, directions or instructions of a director or manager; (vii) any person on whose advice, directions or instructions a director or manager is accustomed to act: Provided that nothing in sub-clauses (vi) and (vii) shall apply to the advice, directions or instructions given in a professional capacity; *****31[(viii) any body corporate which is— (A) a holding, subsidiary or an associate company of such company; (B) a subsidiary of a holding company to which it is also a subsidiary; or (C) an investing company or the venturer of the company;"; |

When we analyse both these definitions, we can see that according to Companies Act,2013, a promote is not even a related party. Further in SEBI LODR, any person forming part of promote or promoter group is a Related Party.

Hence when we look at our example, A ltd being promoter of B ltd is a related party to B ltd, whereas the vice versa is not applicable, i.e., B ltd is not Related Party to A ltd. Hence the approval from Board/Committee/Shareholders is only from B ltd and no approval is required from A ltd, even though it being a listed entity and a promoter to B ltd.

Scenario 2:

Let’s assume A ltd is a listed entity and B ltd is an unlisted public where A ltd is a promoter holding less than 20% shares. Here for all kinds of transactions both the companies need not require any approval, why? Because B ltd only needs to follow companies act, where promoter is not a related party and as per LODR or Companies Act, if you are promoter to a company, that company is not a related party to you.

Conclusion:

This may or may not be a loophole based on the situation or transaction basis. But what I would like to suggest are these:

- Promoter should be brought to the ambit of related party definition under the Companies Act,2013.

- A Company where a person is promoter to, must be related party to that person.

What do you suggest???

DISCLAIMER: THE CONTENTS OF THIS DOCUMENT ARE PROVIDED BASED ON CURRENT PROVISIONS AND INFORMATION AVAILABLE. WHILE EVERY EFFORT HAS BEEN MADE TO ENSURE ACCURACY AND RELIABILITY, NO RESPONSIBILITY IS ASSUMED FOR ANY ERRORS OR OMISSIONS. USERS ARE ENCOURAGED TO REFER TO APPLICABLE LAWS AND REGULATIONS. THIS INFORMATION IS NOT TO BE CONSTRUED AS LEGAL ADVICE, AND NO LIABILITY IS ACCEPTED FOR ANY CONSEQUENCES ARISING FROM ITS USE.

From the Desk of CS SHARATH