View News

Loans to Directors by Private Companies: Legal Framework and Exemptions

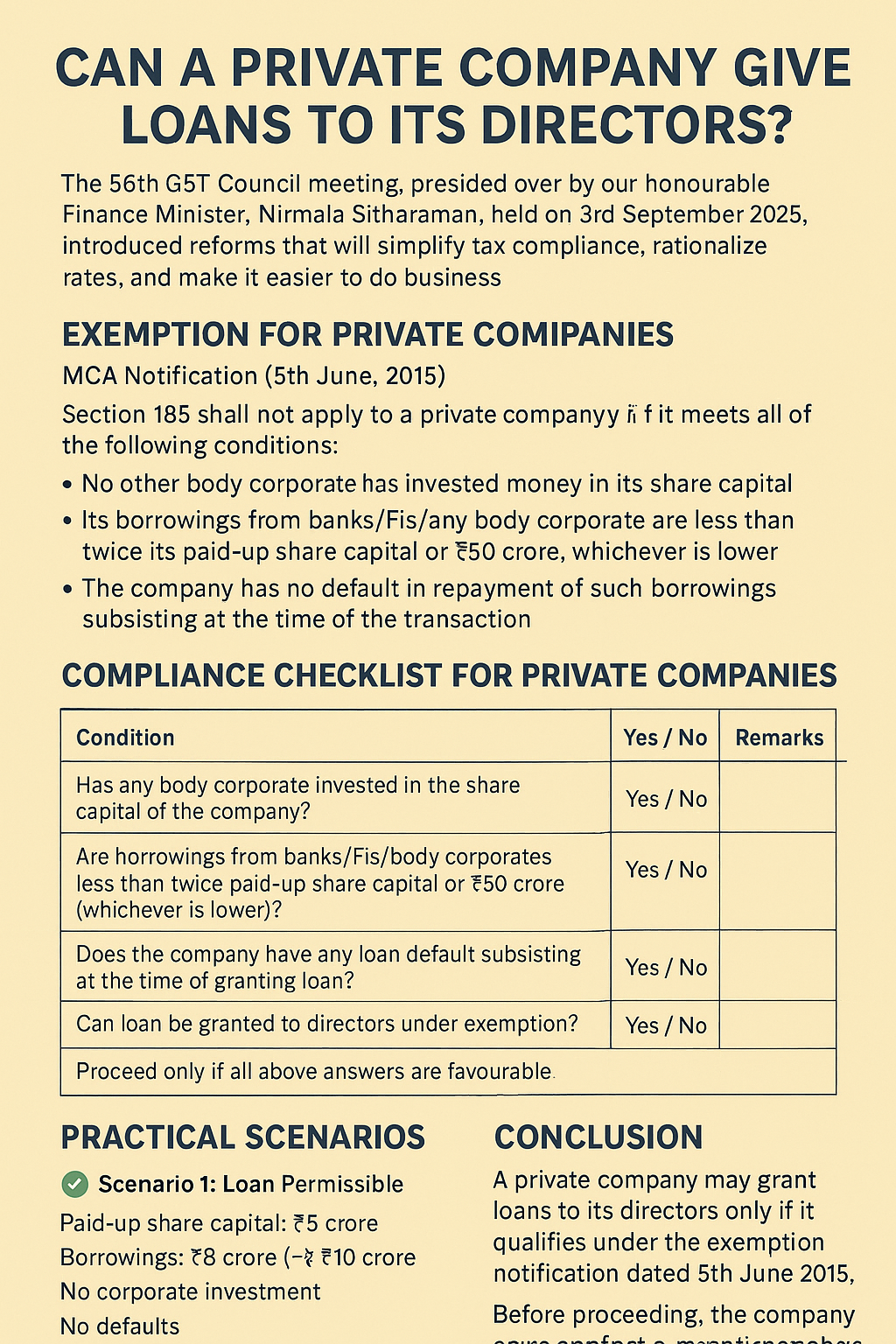

Can a Private Company Give Loans to Its Directors?

1. Legal Provision – Section 185 of the Companies Act, 2013

Section 185 of the Companies Act, 2013 restricts companies from advancing loans, guarantees, or securities to:

- Any director of the company (or its holding company), and

- Any person in whom the director is interested.

This provision is aimed at preventing misuse of company funds by directors.

2. Exemption for Private Companies – MCA Notification (5th June, 2015)

As per the MCA Notification dated 5th June 2015, Section 185 shall not apply to a private company if it meets all of the following conditions:

- No other body corporate has invested money in its share capital.

- Its borrowings from banks/FIs/any body corporate are less than twice its paid-up share capital or Rs 50 crore, whichever is lower.

- The company has no default in repayment of such borrowings subsisting at the time of the transaction.

3. Compliance Checklist for Private Companies

|

Condition |

Yes / No |

Remarks |

|

1. Has any body corporate invested in the share capital of the company? |

Yes / No |

If Yes → Exemption not available |

|

2. Are borrowings from banks/FIs/body corporates less than twice paid-up share capital or Rs 50 crore (whichever is lower)? |

Yes / No |

If No → Exemption not available |

|

3. Does the company have any loan default subsisting at the time of granting loan? |

Yes / No |

If Yes → Exemption not available |

|

Final Check: Can loan be granted to directors under exemption? |

Yes / No |

Proceed only if all above answers are favourable |

4. Practical Scenarios

- Scenario 1: Loan Permissible

- Paid-up share capital: Rs. 5 crore

- Borrowings: Rs. 8 crore (< Rs. 10 crore, i.e., twice capital)

- No corporate investment

- No defaults

- Loan can be granted.

- Scenario 2: Loan Not Permissible (Default Exists)

- Paid-up share capital: Rs. 10 crore

- Borrowings: Rs. 12 crore (within limit)

- No corporate investment

- Default exists

- Loan cannot be granted.

- Scenario 3: Loan Not Permissible (Corporate Investment Exists)

- Paid-up share capital: Rs. 2 crore

- Borrowings: Rs. 50 lakhs (within limit)

- Another company has invested in shares

- Loan cannot be granted.

- Scenario 4: Loan Permissible (No Borrowings)

- Paid-up share capital: Rs. 1 crore

- Borrowings: Nil

- No corporate investment

- Loan can be granted.

5. Conclusion

A private company may grant loans to its directors only if it qualifies under the exemption notification dated 5th June 2015.

Before proceeding, the company must conduct a compliance check using the checklist to ensure:

- No corporate shareholder exists,

- Borrowings are within prescribed limits, and

- No loan defaults subsist.

This ensures the loan is compliant with the law and does not violate Section 185 of the Companies Act, 2013.

DISCLAIMER: THE CONTENTS OF THIS DOCUMENT ARE PROVIDED BASED ON CURRENT PROVISIONS AND INFORMATION AVAILABLE. WHILE EVERY EFFORT HAS BEEN MADE TO ENSURE ACCURACY AND RELIABILITY, NO RESPONSIBILITY IS ASSUMED FOR ANY ERRORS OR OMISSIONS. USERS ARE ENCOURAGED TO REFER TO APPLICABLE LAWS AND REGULATIONS. THIS INFORMATION IS NOT TO BE CONSTRUED AS LEGAL ADVICE, AND NO LIABILITY IS ACCEPTED FOR ANY CONSEQUENCES ARISING FROM ITS USE

From the desk of CS SHARATH