View News

Latest GST Case Laws

Latest GST Case Laws

The Indian judiciary continues to shape the evolving Goods and Services Tax (GST) framework with critical pronouncements on compliance, interpretation, and taxpayers’ rights. On 22nd May 2025, several landmark rulings were delivered by the Supreme Court and various High Courts, clarifying issues around Electronic Credit Ledger (ECrL) blocking, penalties, intermediary services, and jurisdictional powers under the GST law. Below is a detailed analysis of the latest updates:

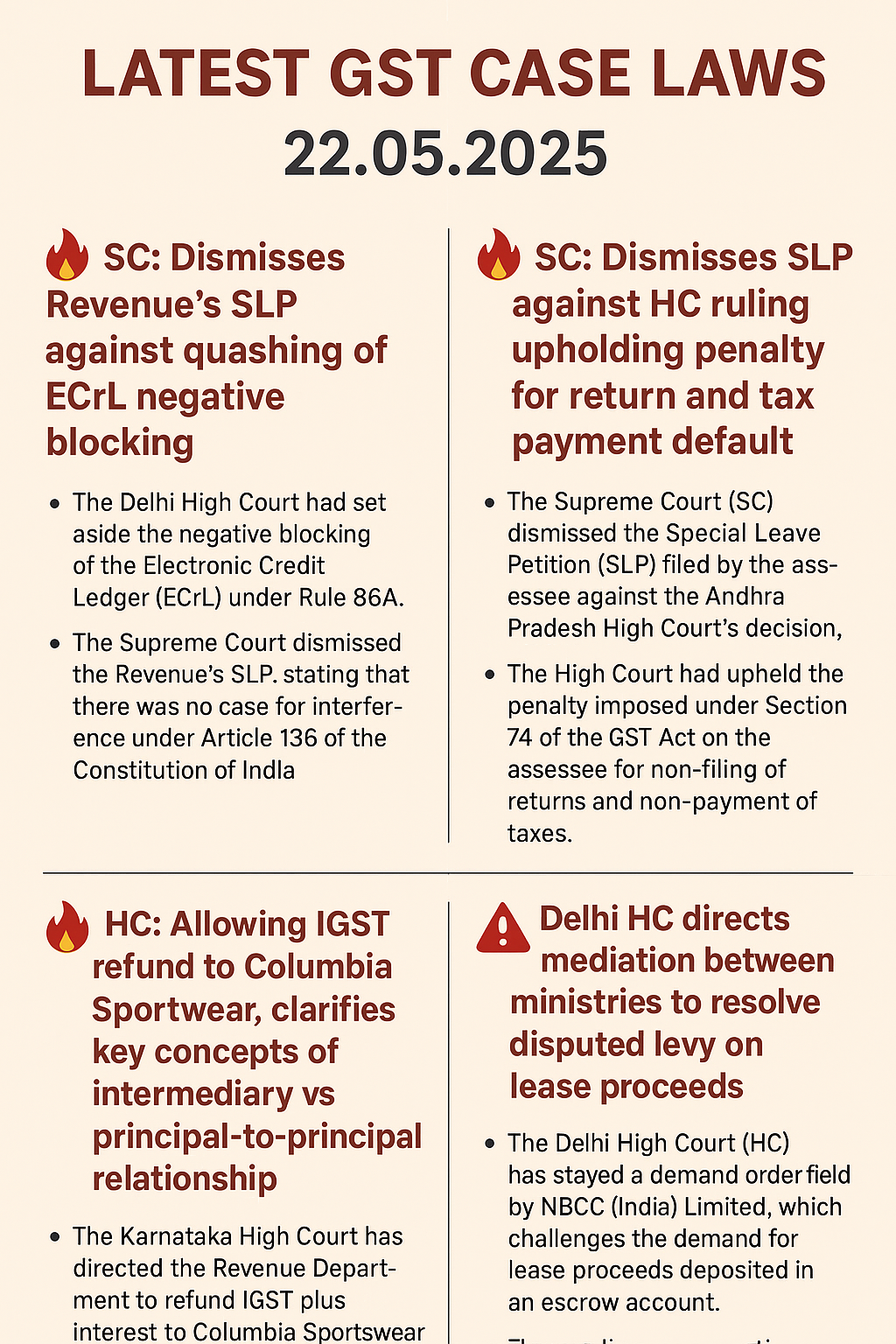

1. SC: Dismissal of Revenue’s SLP against quashing of ECrL negative blocking

-

The Supreme Court dismissed the Revenue’s Special Leave Petition (SLP) challenging the Delhi High Court’s order which had set aside the negative blocking of the Electronic Credit Ledger (ECrL) under Rule 86A.

-

The High Court had relied on the decision in Best Crop Science Ltd., ruling that taxpayers cannot be compelled to replenish their ECrL on the basis of alleged past fraudulent Input Tax Credit (ITC) availment.

-

The Supreme Court found no grounds for interference under Article 136 of the Constitution of India.

-

Case: Director General of Goods and Service Tax Intelligence & Anr. Vs Super Products [SLP (Civil) Diary No. 21064/2025]

2. SC: Dismissal of SLP against penalty for return and tax payment default

-

The Supreme Court rejected an assessee’s appeal against the Andhra Pradesh High Court ruling which upheld a penalty imposed under Section 74 of the GST Act.

-

The High Court had observed that non-filing of monthly returns and non-payment of tax could amount to suppression of facts, even if not outright fraud.

-

The assessee’s defense, that defaults were due to non-payment by its sole client, was rejected.

-

Case: Sriba Nirman Company vs The Commissioner (Appeals), Guntur, Central Tax and Customs & Ors. [SLP (C) No. 14270/2025]

3. Karnataka HC: Refund of IGST to Columbia Sportswear – Clarification on intermediary vs principal-to-principal relationship

-

The Karnataka High Court directed the Revenue to refund IGST along with interest to Columbia Sportswear India Sourcing Pvt. Ltd.

-

The dispute centered around classification of the company’s support services as “intermediary services.” The Court ruled these were export of services, as the company acted independently and did not bind the recipient.

-

Key takeaways from the judgment:

-

Tests for intermediary classification: requires three parties, triangular relationship, and obligation to act on behalf of another.

-

Independent services provided on a principal-to-principal basis cannot be treated as intermediary services.

-

-

The Court also clarified that the refund claim was not time-barred in view of Notification No. 13/2022-Central Tax.

-

Case: Columbia Sportswear India Sourcing Pvt. Ltd. Vs Union of India & Ors. [W.P. No. 12116/2024 (T-RES)]

4. Delhi HC: Mediation between ministries on disputed levy of GST on lease proceeds

-

The Delhi High Court stayed a GST demand raised on NBCC (India) Limited, involving lease proceeds deposited in an escrow account as per an agreement with the Ministry of Urban Development (MoUD).

-

NBCC argued that such transactions with government entities were GST-exempt.

-

The Court directed joint secretaries of MoUD and the Finance Ministry to meet and resolve the issue before 10 July 2025, while adjourning the case to 18 August 2025.

-

Case: NBCC (India) Limited vs Additional Commissioner, CGST Delhi, South & Ors. [W.P.(C) 6687/2025]

5. SC: SLP dismissed – Unblocking of ECrL requires pre-decisional hearing

-

The Supreme Court upheld a High Court ruling that taxpayers must be given a pre-decisional hearing before their Electronic Credit Ledger is blocked under Rule 86A.

-

The Revenue had blocked ITC solely on the basis of a field officer’s report alleging non-existent suppliers, without forming an independent opinion.

-

The Court held that such blocking has serious civil consequences and hence cannot be undertaken without due process.

-

Case: State of Karnataka v. K-9 Enterprises [SLP (Civil) Diary No. 11543/2025]

6. Madras HC: Exercise of powers under Section 168A upheld in exceptional circumstances

-

The assessee challenged the validity of Notification No. 56/2023-CT dated 28.12.2023 and subsequent assessment orders, claiming misuse of powers under Section 168A of the CGST/TNGST Act.

-

The Court held that the notifications were validly issued in light of exceptional circumstances, and the powers exercised were within jurisdiction.

-

No violation of natural justice or constitutional rights was found.

-

Case: Tvl. N.V.R. Sons v. Union of India [W.P.(MD) No. 9947/2025]

Conclusion

These judicial pronouncements underscore several critical principles under GST law:

-

Taxpayers’ rights to due process, particularly regarding ITC blocking under Rule 86A.

-

The judiciary’s role in preventing arbitrary penalties for return defaults.

-

Clear distinction between “intermediary services” and independent export of services.

-

Judicial preference for inter-ministerial coordination in disputes involving government undertakings.

With these rulings, courts have further reinforced taxpayer protections while also ensuring strict adherence to compliance obligations. The evolving jurisprudence highlights the judiciary’s balancing act between safeguarding revenue interests and ensuring fairness to businesses.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc