View News

Insolvency and Bankruptcy Code, 2016

- Formation of Insolvency and Bankruptcy Code, 2016

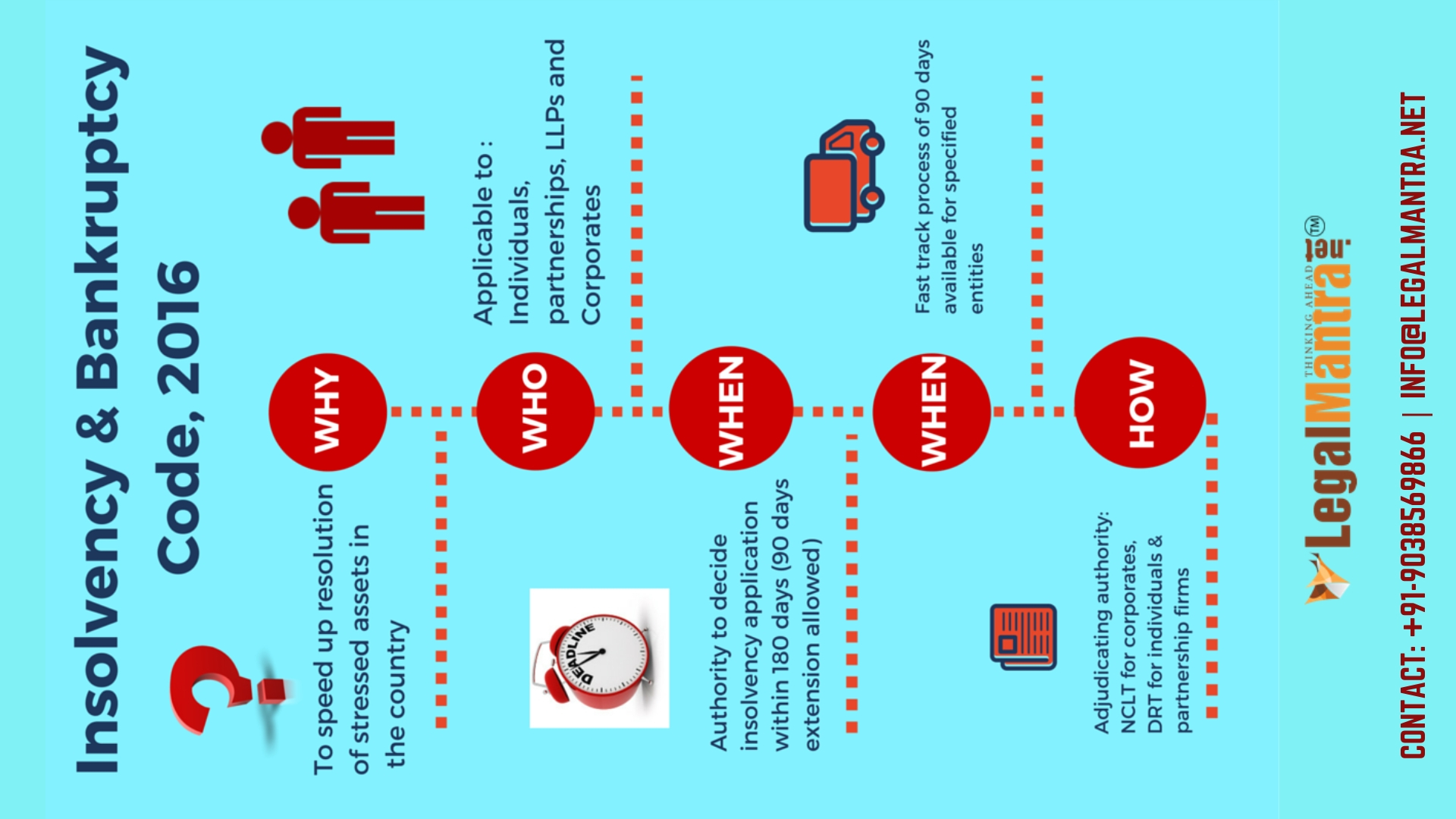

After the introduction of the Insolvency and Bankruptcy Code, 2015 in the Lok Sabha on 21st December 2015, it was referred to the Joint Committee. On such a referral, the Committee had presented its recommendations and a modified the Bill based on its suggestions. In May 2016, both the Houses of Parliament passed the Insolvency and Bankruptcy Code, 2016.

- Shifting Existing Regime ‘Debtor in Possession’ to a ‘Creditor in Control’

In India, the Insolvency and Bankruptcy Code, 2016 is one matured step towards settling the legal position with respect to financial failures and insolvency. To provide easy exit with a painless mechanism in cases of insolvency of individuals as well as companies, the code has significant value for all stakeholders including various government regulators. Introduction of this Code has done away with overlapping provisions contained in various laws –

- Sick Industrial Companies (Special Provisions) Act, 1985

- The Recovery of Debts Due to Banks and Financial Institutions Act, 1993

- The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002

- The Companies Act, 2013.

‘Board for Industrial and Financial Reconstruction (BIFR)’, one of the insolvency regulators, has been a phantasm for sick industrial companies. It is expected that the Insolvency and Bankruptcy Code, 2016 will expedite the cases pending for a long time and resolve them within 180 days with a further period of 90 days.

- Applicability of the Code

The provisions of the Code shall apply for insolvency, liquidation, voluntary liquidation or bankruptcy of the following entities:-

- Any company incorporated under the Companies Act, 2013 or under any previous law.

- Any other company governed by any special act for the time being in force, except in so far as the said provision is inconsistent with the provisions of such Special Act.

- Any Limited Liability Partnership under the LLP Act 2008.

- Set a Limit Between Malfeasance and Business Failure

It can also provide flexibility for parties to arrive at the most efficient solution to maximize value during negotiations. The bankruptcy law will create a platform for negotiation between creditors and external financiers which can create the possibility of such rearrangements.

- Macroeconomic Downturns Losses to be Allocated

An infirm insolvency regime leads to the stereotype of “rich promoters of defaulting entities” generating theories such as:

- Misconduct is the reason for all the defaults made

- Ultimately it is the promoters who should personally and financially be held responsible for defaults of the firms which are under their control

- Key Objectives of the Code

The objective behind Insolvency and Bankruptcy Code, 2016 are listed below:

- To consolidate and amend the laws relating to re-organization and insolvency resolution of corporate persons, partnership firms, and individuals

- To fix time periods for execution of the law in a time-bound settlement of insolvency (i.e. 180 days)

- To maximize the value of assets of interested persons

- To promote entrepreneurship

- To increase the availability of credit

- To balance all stakeholder’s interest (including alteration). Balance to be done in the order of priority of payment of Government dues.

- To establish an Insolvency and Bankruptcy Board of India as a regulatory body for insolvency and bankruptcy law

- To establish higher levels of debt financing across a wide variety of debt instruments

- To provide painless revival mechanism for entities

- To deal with cross-border insolvency

- To resolve India’s bad debt problem by creating a database of defaulters