View News

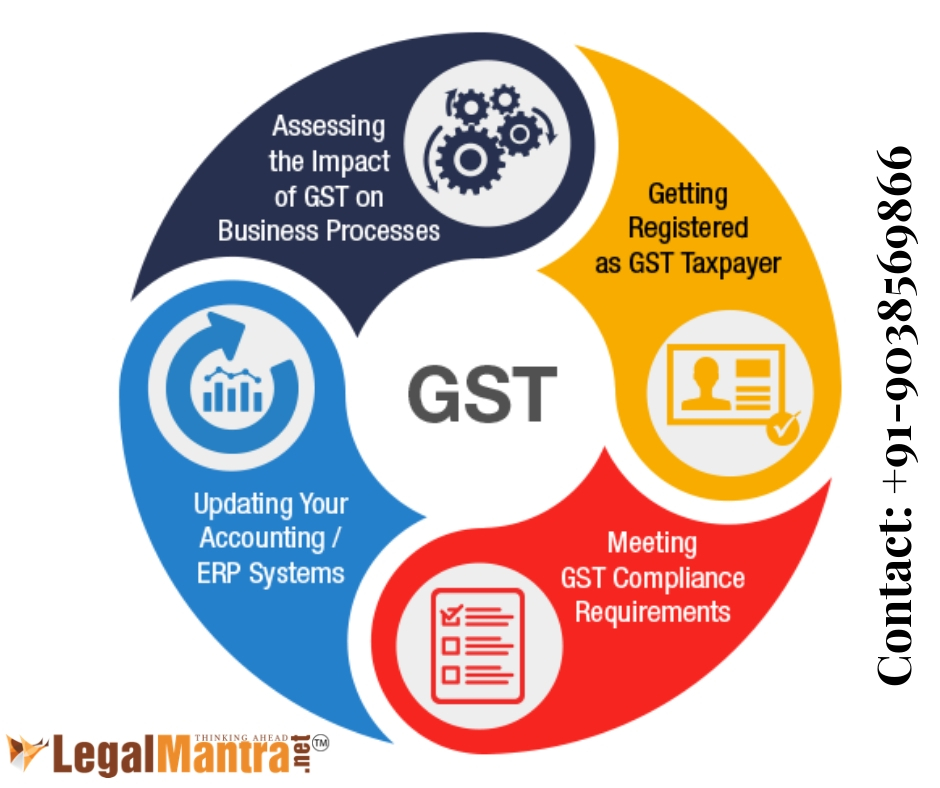

GST Registration

GST Registration in India is now a compulsory requirement for all liable people and economic entities engaged in various economic fields in places all across the country. Since 1st July 2017, the GST Act of India has been promulgated, and all eligible people and entities are require to get registration under the GST regime within 30 days from the date of their liability to do so.

- Understanding the Registration Requirement

Any person with a taxable supply turnover of over Rs. 25 lakhs is required to register for GST in India. There is also a mechanism available for voluntary registration to help claim input tax credit. The term “person” under GST law, who are required to pay it, includes proprietorship, partnership firms, Hindu Undivided Family, company, LLP, society and any other legal entity.

- When GST Registration is Mandatorily Required?

Any business which falls under the purview of the following pointers is liable to be registered under GST and should have a GSTIN:

- An intra-state business with an annual turnover of INR 20 lakhs and above

- All inter-state business irrespective of the annual turnover

- All e-commerce businesses, irrespective of the turnover

- To claim Input Tax Credit, a business should be having GSTIN, irrespective of its annual turnover

- For multiple businesses in different states, separate registrations are required

- Casual taxable person making taxable supply

- Persons who are required to pay tax under Reverse Charge

- Non-resident taxable person making taxable supply.

- Persons who are required to deduct tax under Section 51, whether or not separately registered under this Act

- Input Service Distributor, whether or not separately registered under this Act

- Persons Not Liable to be Registered

Following persons are not liable for registration:

- Exempted Goods or Services:

Any person who is engaged exclusively in supply of those goods or services which are wholly exempted from tax or are not liable to pay tax under CGST or under IGST Act.

- An Agriculturist:

For those supply only which is produced out of cultivation of land.

- Notified Person:

Furthermore, the government on the recommendation of the GST council may issue notification & specify special category of persons who are not liable for registration.

- Online GST Registration Procedure:

Registration for GST can be done online through a portal maintained by the Central Government or State Government.

The applicant will have to submit an online application for GST registration using Form GST-1 along with detail of the goods and services to be dealt. Online payment for the registration fee would be made available and temporary GST registration number would be provided on submission of application. GST registration procedure is a completely online process, similar to the service tax registration process.

Here is a step-by-step guide on how to complete registration process online on the GST Portal-

Step 1 – Enter the following details in Part A –

- Select New Registration

- In the drop-down under I am a – select Taxpayer

- Select State and District from the drop down

- Enter the Name of Business and PAN of the business

- Key in the Email Address and Mobile Number. The registered email id and mobile number will receive the OTPs.

Step 2 – Enter the OTP received on the email and mobile. Click on Continue. If you have not received the OTP, click on Resend OTP.

Step 3 – You will receive the Temporary Reference Number (TRN) now. This will also be sent to your email and mobile. Note down the TRN.

Step 4 – Select Temporary Reference Number (TRN). Enter the TRN and the captcha code and click on Proceed.

Step 5 – You will receive an OTP on the registered mobile and email. Enter the OTP and click on Proceed

Step 6 – Part B has 10 sections. Fill in all the details and submit appropriate documents.

Here is the list of documents you need to keep handy while applying for GST registration-

- Photographs

- Constitution of the taxpayer

- Proof for the place of business

- Bank account details

- Authorization form

Step 7 – Once all the details are filled in, go to the Verification page. Tick on the declaration and submit the application using any of the following ways –

- Companies must submit application using DSC

- Using e-Sign– OTP will be sent to Aadhaar registered number

- Using EVC– OTP will be sent to the registered mobile

- Multiple GST Registrations for Different States:

The registration in GST is PAN based and state specific. A supplier has to register in each of such state/ union territory, from where he affects supply. In GST, the supplier is allotted a 15-digit GST identification number called GSTIN and a certificate of registration incorporating this GSTIN.

A given PAN based legal entity would have one GSTIN per state, that means a business entity having its branches in multiple states will have to take separate state wise registrations for the branches in different states. However, an intra-state entity with different branches can have single registration wherein it can declare one place as principal place of business and other branches as additional place of business. However, a business entity having separate business verticals in a state may obtain separate registration for each of its business verticals.

- Details and Documents Required for GST Registration

The documents required depends upon the type of business you are running. Following below documents are required for GST Registration: –

- Passport size photograph

- Aadhar card or Passport or Driving License

- PAN card of business entity

- Address proof of business premises

- Bank Statement or cancelled cheque or passbook

Additional documents for private limited company /LLP /OPC /partnership firm are:

- Certificate of Incorporation in case of company, OPC or LLP

- Partnership deed in case of partnership firm.

- Penalty for Non-Registration Under GST

If any business entity mandatorily required to register under GST, however, failed to apply or intentionally ignoring the same, then business is liable to pay the penalty of 100% of the tax due or INR. 10,000 whichever is higher.