View News

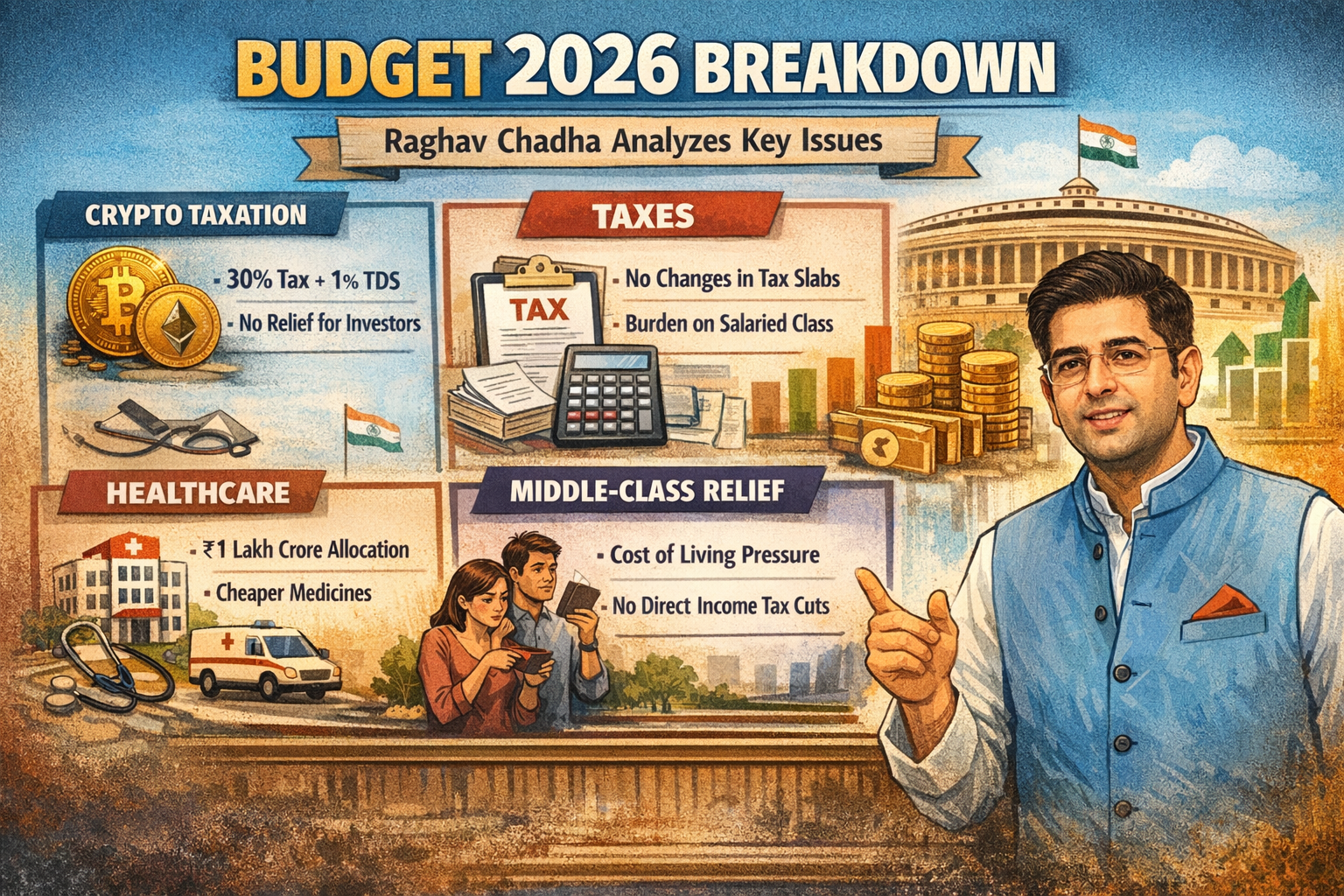

Crypto, Taxes, Healthcare & Middle-Class Relief: Raghav Chadha’s Perspective on Union Budget 2026

Crypto, Taxes, Healthcare & Middle-Class Relief: Raghav Chadha’s Perspective on Union Budget 2026

Introduction

The Union Budget 2026–27, presented by the Union Finance Minister on 1 February 2026, has once again triggered a nationwide debate on whether India’s fiscal policy truly addresses the economic realities of its citizens. While the Government has projected the budget as growth-oriented and fiscally disciplined, opposition leaders and policy analysts have questioned its impact on the middle class, emerging digital sectors, and essential social services. Among the prominent voices, Aam Aadmi Party leader and Chartered Accountant Raghav Chadha has offered a critical breakdown of the budget, focusing on cryptocurrency taxation, personal taxes, healthcare spending, and the absence of substantial middle-class relief. This article analyses Budget 2026 through these lenses, blending legal, economic and policy perspectives.

Crypto Taxation under Budget 2026: Continuity without Reform

Existing Tax Framework Continues

One of the most closely watched aspects of Budget 2026 was the Government’s stance on cryptocurrency and virtual digital assets. However, the budget maintained the existing taxation framework without introducing any relief or structural reform. Income arising from the transfer of cryptocurrencies continues to be taxed at a flat rate of 30 percent, without allowing deduction of expenses except for the cost of acquisition. Additionally, the one percent tax deducted at source on every crypto transaction remains unchanged. This approach reflects the Government’s continued caution towards digital assets, prioritising revenue assurance and regulatory oversight over market expansion.

Compliance-Driven Approach

Budget 2026 further strengthened the compliance architecture surrounding virtual digital assets. Enhanced reporting obligations and stricter penalties for non-disclosure indicate that the Government views crypto primarily through the lens of tax enforcement rather than innovation. While the absence of clarity on regulation persists, the tax framework sends a clear message that crypto transactions are firmly within the tax net and subject to scrutiny.

Raghav Chadha’s Criticism on Crypto Policy

Raghav Chadha criticised the Government for ignoring repeated demands from industry stakeholders for rationalisation of crypto taxation. According to him, the excessive tax burden and transaction-level TDS discourage legitimate trading and push investors towards unregulated or offshore platforms. From his perspective, the budget missed an opportunity to recognise crypto as a legitimate asset class and to balance regulation with growth.

Personal Taxation and the Middle Class: Stability without Relief

No Change in Tax Slabs

Budget 2026 did not revise personal income tax slabs under either the old or the new tax regime. While this ensured predictability and continuity, it also meant that salaried individuals did not receive any direct tax relief despite rising inflation and living costs. The absence of enhanced deductions or increased exemption limits has been perceived as a major disappointment for middle-income taxpayers.

Procedural Rationalisation

Although headline tax rates remained unchanged, the budget introduced certain procedural simplifications. Rationalisation of tax collected at source on overseas remittances for education and medical purposes reduced the immediate financial burden on families. Extended timelines and simplified compliance processes were also announced, aiming to reduce litigation and procedural hardships for individual taxpayers. However, these measures offer administrative comfort rather than tangible monetary relief.

Chadha’s View on Middle-Class Tax Burden

Raghav Chadha strongly argued that the middle class continues to remain the most taxed and least protected segment of society. According to his critique, the Government celebrates marginal procedural relaxations while ignoring the cumulative burden of direct taxes, indirect taxes, EMIs, education costs and healthcare expenses. He emphasised that without real disposable income enhancement, claims of middle-class relief remain largely symbolic.

Healthcare in Budget 2026: Structural Support over Immediate Benefits

Increased Allocation and Policy Focus

Healthcare emerged as one of the key focus areas in Budget 2026, with a significant increase in budgetary allocation crossing the one-lakh-crore mark. The Government reaffirmed its commitment to strengthening public healthcare infrastructure, expanding the National Health Mission, and improving access under schemes such as Ayushman Bharat. This reflects a long-term approach towards building healthcare capacity rather than short-term populist measures.

Reduction in Treatment Costs

The budget introduced relief measures aimed at reducing the cost of critical medical treatment. Customs duty exemptions and reductions on essential cancer drugs and medicines for rare diseases are expected to ease financial stress on patients and families. Such measures indirectly benefit the middle class, which often bears high out-of-pocket healthcare expenses due to limited insurance coverage.

Healthcare Workforce and Innovation

Budget 2026 also focused on expanding the healthcare workforce and promoting medical research and innovation. Investments in skill development for healthcare professionals, strengthening tertiary care institutions, and promoting India as a medical research and tourism hub were highlighted. From a legal and regulatory standpoint, this signals increased activity in healthcare compliance, licensing and public-private partnerships.

Middle-Class Relief: Indirect Measures and Political Debate

Absence of Direct Economic Relief

One of the central criticisms of Budget 2026 is the absence of direct economic relief for the middle class. No reduction in income tax rates, no increase in standard deduction, and no significant GST rationalisation on daily-use items were announced. For many households, rising costs of housing, education, healthcare and fuel continue to outpace income growth.

Indirect Benefits and Long-Term Impact

The Government’s defence rests on indirect relief measures such as healthcare cost reduction, infrastructure expansion, and employment generation. Increased public spending is expected to create jobs and stimulate economic growth, which may benefit the middle class over time. However, critics argue that these benefits are uncertain and delayed, whereas financial pressures are immediate and persistent.

Raghav Chadha’s Broader Political Narrative

Raghav Chadha framed Budget 2026 as another example of policy disconnect between fiscal numbers and household realities. According to him, the middle class is repeatedly asked to shoulder the nation’s tax burden without receiving proportional support in return. His critique resonates with salaried taxpayers who perceive that welfare schemes largely bypass them while compliance expectations continue to rise.

Conclusion

Union Budget 2026 reflects a policy of continuity, caution and structural investment rather than bold reform. The Government chose to maintain its firm stance on crypto taxation, prioritise compliance in personal taxation, and invest heavily in healthcare infrastructure. While these measures contribute to long-term economic stability, they fall short of delivering immediate and visible relief to the middle class. Raghav Chadha’s critique underscores the growing sentiment that fiscal policy must move beyond procedural ease and long-term promises to address the day-to-day financial stress faced by ordinary taxpayers. As legal professionals, policymakers and citizens assess the budget’s impact, the debate over equity, relief and responsibility remains far from settled.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc

LegalMantra.net team

Anshul Goel