View News

24 May 2019

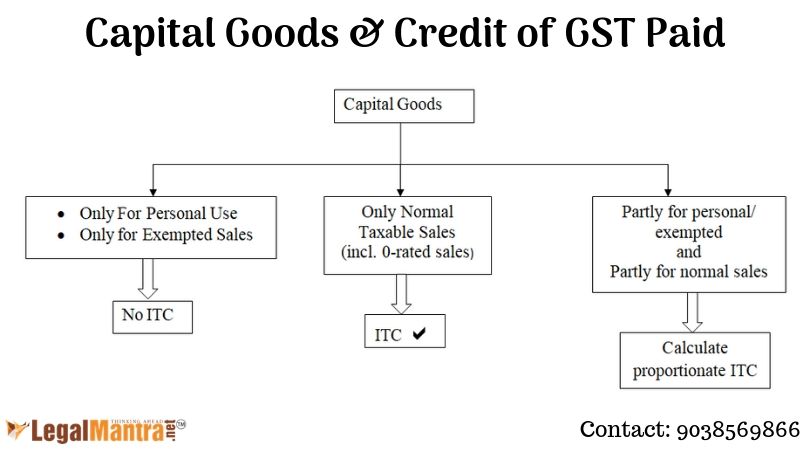

Capital Goods & Credit of GST Paid

- In GST, the credit can be availed on the capital goods provided the depreciation of tax component is not claimed.

- ITC of capital goods can be availed fully if the capital goods are used only for the supply of taxable goods or services.

- ITC of capital goods cannot be availed fully if the capital goods are used only for manufacturing or selling or providing exempt goods or services or used for personal purposes.

- If the capital goods are used partly for taxable supplies and partly for exempted supplies, then the credit of the capital goods related to the particular month should be reversed which is attributable to exempt supplies on a proportionate turnover basis. The useful life of the capital good is deemed to be 5 years for this purpose.

- ITC of the capital goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples, or used for personal consumption cannot be availed.

- Eligibility of credit of certain particular capital goods under GST:

-

- Works contract services and construction services:

The goods/ services used for the construction of buildings for business purposes including works contract services are restricted if such buildings are capitalized in the books of accounts.

-

- Plant and machinery:

However, plant and machinery are excluded from construction and works contract services in the case of eligibility of credit. It is defined as apparatus, equipment, and machinery fixed to earth by foundation or structural support and includes such foundation and structural supports.

- Depreciation on the tax component of such plant and machinery is not claimed in the Income Tax act; and

- Such plant and machinery are used in effecting taxable supplies in the course or furtherance of business.

-

- Motor vehicles:

The credit of cars, bikes, etc., has been restricted under GST. However, ITC of motor vehicles for transportation of persons having approved seating capacity of more than 13 persons (including the driver) can be availed.

-

- Miscellaneous:

- A composition dealer and a non-resident taxable person cannot avail credit of capital goods. However, a non-resident taxable person can avail the credit of tax paid on the import of such capital goods.

- In the case of a composition dealer converting to the regular registered person or when the exempted goods become taxable, for which the capital goods are used, ITC of capital goods held on the preceding day to such conversion or change in rate can be availed. Full credit cannot be availed. The ITC should be reduced at 5% per quarter (or part thereof) from the invoice date till the date of conversion or change in rate.

- If a person registered under GST under the regular scheme gets converted to composition scheme, or the goods or services for which the capital goods are being used, become exempt, ITC of the capital goods is not eligible. Therefore, the credit should be reversed.