View News

Applicability of RPT Industry Standards under Regulation 23 of SEBI LODR, 2015

Applicability of RPT Industry Standards under Regulation 23 of SEBI LODR, 2015

1. Introduction

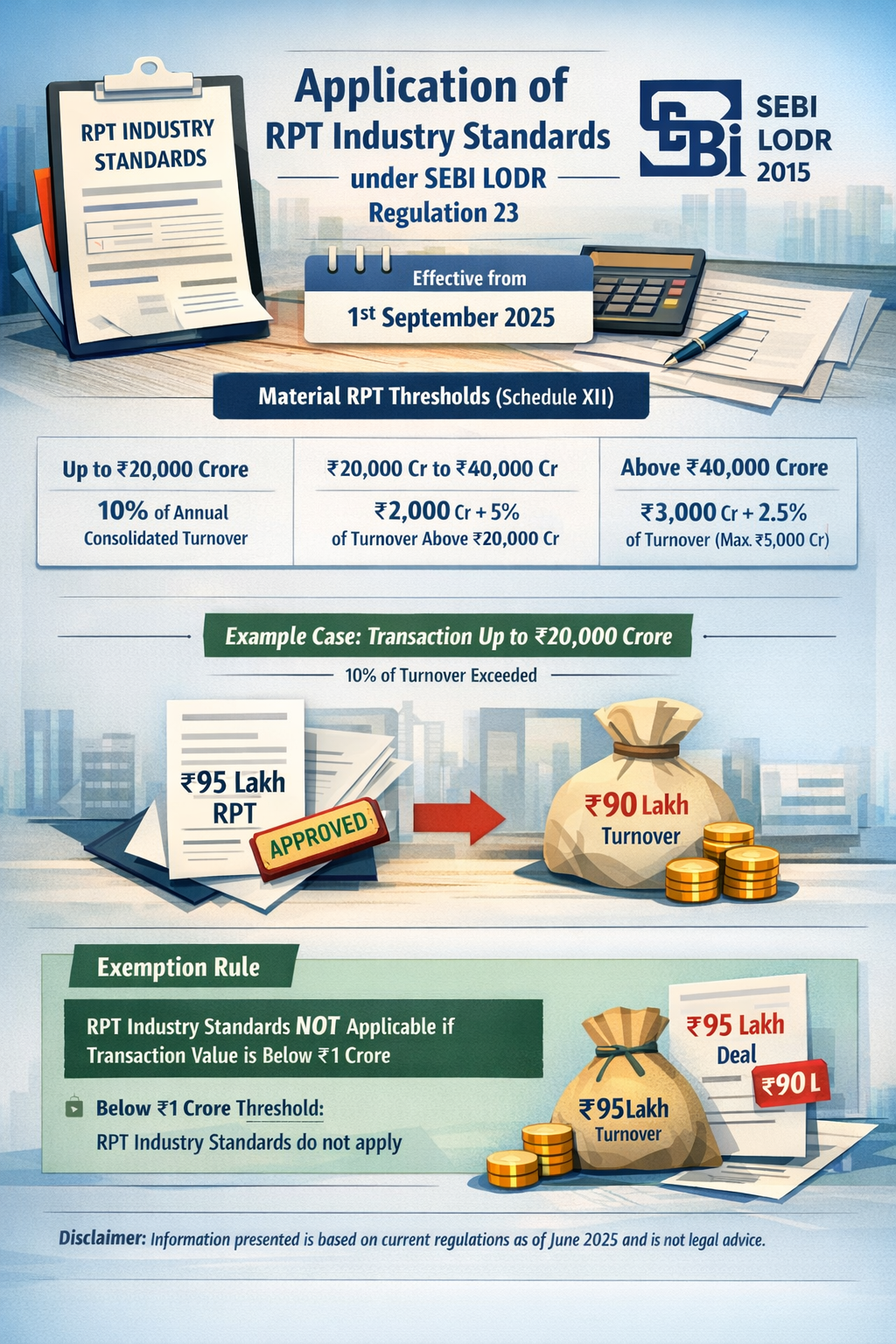

Related Party Transactions (RPTs) have always been a sensitive area of corporate governance, especially for listed entities. To enhance transparency, uniformity, and investor protection, SEBI has introduced Industry Standards for Related Party Transactions ("RPT Industry Standards"). A recurring practical question is whether these standards apply to all material RPTs approved under Regulation 23 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 ("SEBI LODR Regulations").

This article examines the scope, thresholds, and exemptions under the RPT Industry Standards and clarifies their applicability with practical illustrations.

2. Regulatory Framework

2.1 Regulation 23 of SEBI LODR, 2015

Regulation 23 governs approval, disclosure, and oversight of related party transactions by listed entities. It mandates:

| Particulars | Requirement under Regulation 23 |

|---|---|

| Audit Committee Approval | Prior approval of the Audit Committee is mandatory for all related party transactions |

| Shareholder Approval | Mandatory for material related party transactions |

| Disclosure & Safeguards | Prescribed disclosures and governance safeguards to prevent abuse |

A transaction with a related party is treated as material if it exceeds the thresholds specified in Schedule XII of the SEBI LODR Regulations.

3. What are the RPT Industry Standards?

The RPT Industry Standards prescribe the minimum information to be placed before:

- the Audit Committee, and

- the shareholders

for approval of related party transactions.

Effective Date

The RPT Industry Standards are applicable from 1st September, 2025, pursuant to SEBI Circular No. SEBI/HO/CFD/CFD-PoD-2/P/CIR/2025/93 dated 26 June 2025.

4. Thresholds for Material Related Party Transactions

As per Schedule XII of the SEBI LODR Regulations, a related party transaction shall be considered material if the transaction(s), whether entered into individually or taken together with previous transactions during a financial year, exceeds the following limits based on annual consolidated turnover:

| Annual Consolidated Turnover of the Listed Entity | Threshold for Material Related Party Transaction |

| Up to Rs 20,000 crore | 10% of the annual consolidated turnover |

| More than Rs 20,000 crore and up to Rs 40,000 crore | Rs 2,000 crore + 5% of the annual consolidated turnover above Rs 20,000 crore |

| More than Rs 40,000 crore | Rs 3,000 crore + 2.5% of the annual consolidated turnover above Rs 40,000 crore or Rs 5,000 crore, whichever is lower |

Once these thresholds are crossed, the transaction qualifies as a material RPT under Regulation 23.

5. Do RPT Industry Standards Apply to All Material RPTs?

At first glance, it may appear that once a transaction is classified as material under Regulation 23, compliance with the RPT Industry Standards becomes mandatory. However, this is not always the case.

Key Exemption under the RPT Industry Standards

Paragraph 1(3) of the RPT Industry Standards provides a crucial exemption:

The RPT Industry Standards shall not apply to related party transactions below Rs 1 crore, even if such transactions are otherwise classified as material under Regulation 23 of SEBI LODR.

6. Practical Illustration

Let us understand this through a simple example:

-

Annual consolidated turnover of a listed entity: Rs 9 crore

-

Materiality threshold (10%): Rs 90 lakh

-

Proposed related party transaction value: Rs 95 lakh

Regulatory Position:

-

Since Rs 95 lakh exceeds 10% of the annual consolidated turnover, the transaction qualifies as a material RPT under Regulation 23(1) of SEBI LODR.

-

However, as the transaction value is below Rs 1 crore, the RPT Industry Standards do not apply, by virtue of Para 1(3) of the Standards.

Result:

-

Shareholder and Audit Committee approvals under Regulation 23 remain applicable.

-

Disclosure and approval need not follow the minimum information format prescribed under the RPT Industry Standards.

7. Discretion of the Board and Audit Committee

Although the RPT Industry Standards are not mandatory for RPTs below ?1 crore, the regulations provide flexibility:

-

The Board of Directors and

-

the Audit Committee

may, at their discretion, prescribe minimum information requirements for such transactions.

This can be achieved by incorporating suitable provisions in the Related Party Transactions Policy, formulated under Regulation 23(1) of SEBI LODR.

8. Key Takeaways

| Aspect | Position |

| Applicability of RPT Industry Standards | Not all material RPTs automatically attract RPT Industry Standards |

| Rs 1 Crore Threshold | RPT Industry Standards do not apply to transactions below ?1 crore even if material |

| Regulation 23 Compliance | Audit Committee and shareholder approvals continue to apply |

| Board & Audit Committee Discretion | Internal disclosure norms may be prescribed through RPT Policy |

9. Conclusion

The RPT Industry Standards aim to standardize disclosures for significant related party transactions, but they consciously exclude smaller-value transactions to avoid excessive compliance burden. Listed entities must therefore examine both the materiality thresholds under Schedule XII and the ?1 crore exemption under the Industry Standards before determining the applicable compliance framework.

A careful reading of Regulation 23, Schedule XII, and the RPT Industry Standards together is essential to ensure accurate compliance and robust corporate governance.

Disclaimer

The contents of this article are based on the applicable legal provisions and information available as on date. While due care has been taken to ensure accuracy, this write-up is for informational purposes only and does not constitute legal advice. Readers are advised to refer to the relevant statutes, regulations, circulars, and professional advisors before taking any action. No liability is accepted for any loss arising from reliance on this article.

From the desk of CS Sharath