View News

Unraveling-the-Sahara-Scam-A-Story-of-Subrata-Roy

Unraveling the Sahara Scam - A Story of Subrata Roy

Introduction:

The annals of India's corporate history bear witness to the Sahara scam, a financial saga that unfolded over the span of a decade. Initiated in 2009, this Rs 25,000 Crore fraud orchestrated by Subrata Roy, the chairman of Sahara India Pariwar, brought to light intricate webs of financial mismanagement, money laundering, and legal battles. This extensive article meticulously explores the Sahara scam, delving into its origins, the modus operandi, the legal intricacies, and the aftermath that has left an indelible mark on India's corporate landscape.

Genesis of Sahara India Pariwar:

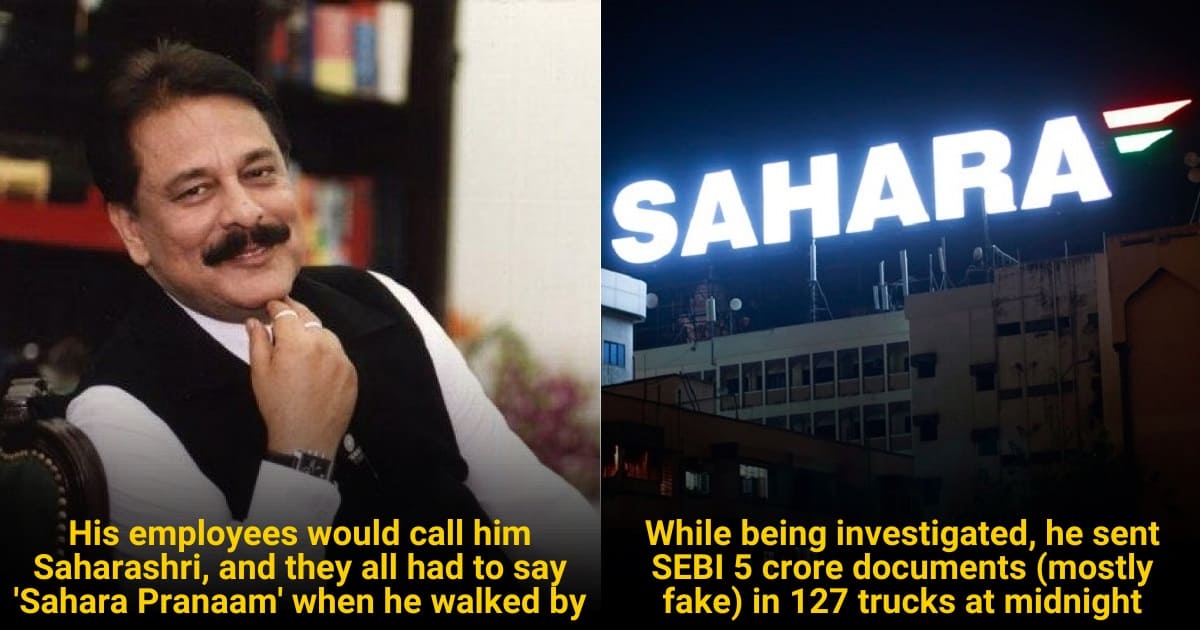

Sahara India Pariwar, founded by Subrata Roy in 1978, started as a venture to raise funds by encouraging public investments. The conglomerate diversified its interests into finance, media, entertainment, construction, and more. Boasting over 1.4 million employees across 5,000 establishments, Sahara's rapid growth attracted the scrutiny of regulatory authorities.

Emergence of the Sahara Scam:

The Sahara scam's roots can be traced to a complaint by chartered accountant RoshanLal regarding housing bonds issued by Sahara group companies - Sahara India Real Estate Corporation (SIREC) and Sahara Housing Investment Corporation (SHIC). The National Housing Bank (NHB) forwarded the complaint to the Securities and Exchange Board of India (SEBI), marking the inception of a protracted investigation.

SEBI's scrutiny revealed the dubious use of Optionally Fully Convertible Debentures (OFCDs) by SIREC and SHIC, leading to substantial increases in their capital pools. The prospectus, misleadingly labeling Sahara as a private company despite operating as a public one, further fueled suspicions of financial irregularities.

Legal Proceedings Against Subrata Roy:

The turning point in the Sahara scam occurred on February 26, 2014, when the Supreme Court issued a non-bailable summons for Subrata Roy. The court mandated a deposit of Rs. 25,000 Crore in three installments with a 15% interest rate to SEBI. While Subrata Roy made the initial payment of Rs. 5120 Crores, the subsequent two payments were never fulfilled, with claims that investors had already been reimbursed.

The rarity of such corporate accountability marked Subrata Roy's detention in 2014. In November 2017, the Enforcement Directorate accused the Sahara Group of money laundering, adding another layer to the legal quagmire.

Constant Money Laundering by Subrata Roy:

In a bold move, Sahara attempted to provide evidence by sending 170 trucks filled with investor information to SEBI. However, only a fraction was accepted, revealing inaccuracies in the data. Subrata Roy's argument that funds had been disbursed to investors was challenged, leading the court to demand proof of the funding source for these purported returns.

The Legal Quagmire and SEBI's Role:

The Sahara scam shed light on the challenges faced by regulatory bodies, particularly SEBI, in curbing corporate malpractices. SEBI's crucial role in uncovering the scam and subsequent legal proceedings underscored the importance of robust regulatory mechanisms. The discrepancies in Sahara's prospectus, mislabeling the company's status, and the misuse of financial instruments like OFCDs highlighted the need for stringent oversight in financial markets.

Where is Subrata Roy Now and His Net Worth?

As of the latest reports, Subrata Roy is reportedly residing in his home in Lucknow, Uttar Pradesh. Despite his legal battles and the tarnished reputation, Subrata Roy's net worth is estimated to be around $200,000.

Lessons Learned and the Future of Corporate Governance:

The Sahara scam serves as a stark reminder of the systemic inefficiencies in dealing with corporate malpractices. The prolonged duration of the scam, from its inception in 2009 to the first conviction in 2014, underscores the need for proactive regulatory measures, judicial activism, and public awareness to safeguard investor interests.

In the ever-evolving landscape of corporate governance, the Sahara scam provides crucial lessons. The importance of regulatory bodies like SEBI in uncovering financial irregularities, the need for stringent oversight in financial markets, and the challenges posed by legal loopholes and the influence of money and power have been vividly demonstrated.

Ray of Hope:

Amidst the chaos and financial devastation caused by Sahara's illicit activities, a glimmer of hope emerged with the government's launch of the CRCS Sahara refund portal. This initiative, set to benefit approximately one crore depositors, promises to restore the hard-earned money to those who invested in Sahara.

CRCS - Sahara Refund Portal:

Establishment: Launched on July 18, 2023, the CRCS Sahara Refund Portal stands as an online platform established by the Central Registrar of Cooperative Societies (CRCS) to facilitate eligible depositors in claiming their refunds.

Eligibility Criteria: Investors seeking refunds must have invested in one of the four Sahara Group cooperative societies directed by the Supreme Court. These societies include Sahara Credit Cooperative Society Ltd., Saharayan Universal Multipurpose Society Ltd., Humara India Credit Cooperative Society Ltd., and Stars Multipurpose Cooperative Society Ltd.

Languages and Charges: Accessible in English and Hindi, the portal ensures that the application process is free of charge, allowing claimants to seek refunds without financial barriers.

Payment Procedure: Operating on a trial basis, the portal plans to initiate the first payment of up to Rs.10,000 to one crore investors who had deposited Rs. 10,000 or more. After completing the Rs.5,000 crore payment, an additional appeal will be made to the Supreme Court for the remaining investors.

Procedure of Application under Sahara Refund Portal:

Registration: Initiating the process, depositors provide personal details such as membership number, name, address, AADHAR, and PAN number.

Verification: Mobile number linkage with AADHAR is imperative for verification via OTP, ensuring the authenticity of the claimant.

Claim Submission: Deposit holders submit claims and details as per the Certificate of Deposit, providing a comprehensive overview of their investments.

Document Upload: The portal prompts depositors to upload copies of their investment documents, ensuring transparency and accuracy in the refund process.

Review and Approval: A committee oversees the applications, reviewing them for accuracy and legitimacy. If approved, the refund is processed within the assured timeline of 45 days, providing a swift resolution for depositors.

Frequently Asked Questions (FAQs) - CRCS Sahara Refund Portal:

1. What is the CRCS Sahara Refund Portal, and who manages it?

The CRCS Sahara Refund Portal is an online platform administered by the Central Registrar of Cooperative Societies (CRCS). It is designed to assist eligible depositors of Sahara India Group in reclaiming their funds.

2. Which cooperative societies are covered under the refund portal?

The refund portal encompasses four Sahara Group cooperative societies, namely Sahara Credit Cooperative Society Ltd., Saharayan Universal Multipurpose Society Ltd., Humara India Credit Cooperative Society Ltd., and Stars Multipurpose Cooperative Society Ltd.

3. How can I initiate the refund process through the CRCS Sahara Refund Portal?

To commence the refund process, visit [https://mocrefund.crcs.gov.in](https://mocrefund.crcs.gov.in), where you can register by providing necessary personal information, submit your claims, and upload the required documents.

4. What is the timeline for refund approval and disbursement?

Once your application is submitted, a committee will diligently review the details. If your application is approved, refunds are assured to be processed within a period of 45 days, providing a swift resolution for eligible claimants.

5. Are there any charges associated with using the CRCS Sahara Refund Portal?

No, the CRCS Sahara Refund Portal is entirely free of charge. Claimants can utilize the portal to apply for a refund without incurring any fees, ensuring accessibility and fairness in the refund process.

Conclusion:

The Sahara scam stands as a testament to the complexities and challenges inherent in India's corporate landscape. Subrata Roy's actions, the legal battles, and the subsequent fallout have left an indelible mark on the nation's financial history. As we navigate the aftermath of the Sahara scam, it becomes imperative to address the systemic shortcomings, fortify regulatory frameworks, and foster a culture of transparency and accountability in corporate governance.

The Sahara saga is a cautionary tale, urging stakeholders, regulators, and the legal system to collectively strive for a future where financial improprieties are swiftly identified, perpetrators are held accountable, and investor trust is safeguarded. In the face of evolving economic landscapes, the lessons from the Sahara scam serve as a compass guiding us toward a more resilient and responsible corporate ecosystem.

“Unlock the Potential of Legal Expertise with LegallMantra.net - Your Trusted Legal Consultancy Partner”

Article Compiled by:-

Mayank Garg

(LegalMantra.net Team)

+91 9582627751

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc