View News

Understanding-the-Disclosure-of-Promoter-Group-Entities-in-Shareholding-Patterns-under-Regulation-ThirtyOne

Understanding the Disclosure of Promoter Group Entities in Shareholding Patterns under Regulation 31

Introduction

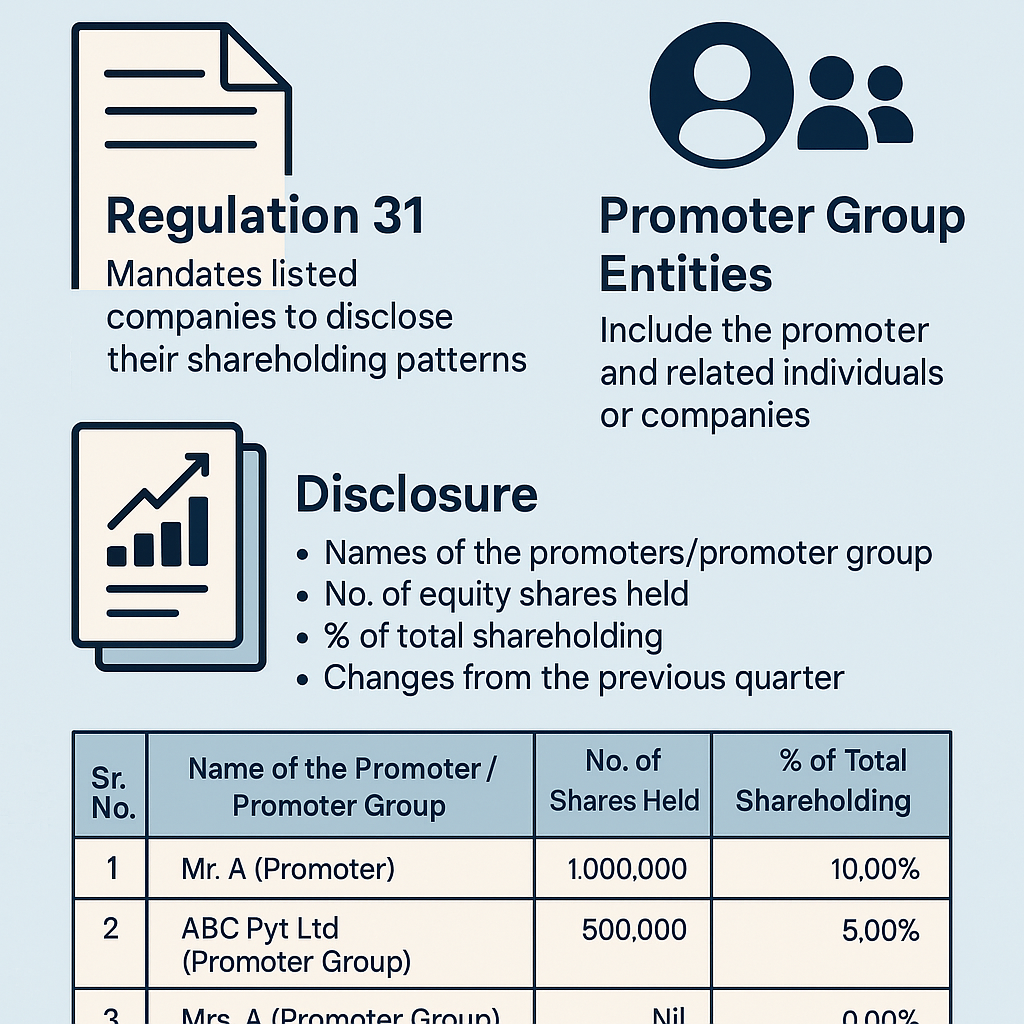

In the world of corporate governance and regulatory compliance, transparency in shareholding patterns is crucial for listed entities. This transparency allows investors, analysts, and regulators to understand the ownership structure of a company and assess the potential influence of significant stakeholders. The Securities and Exchange Board of India (SEBI) has laid down clear guidelines for the disclosure of shareholding patterns under Regulation 31 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

The purpose of this regulation is to ensure that the stock exchanges and the general public are made aware of the ownership structure of listed entities. However, a key question arises: should entities under the Promoter Group be disclosed in the shareholding pattern, even if they do not hold any shares? This article aims to address this question by analyzing the relevant provisions and drawing a logical conclusion.

Regulatory Requirements under Regulation 31

Regulation 31(1) of the SEBI Listing Regulations mandates that listed companies disclose their shareholding patterns in the following circumstances:

- Pre-listing: One day prior to the listing of securities on the stock exchange(s).

- Quarterly Disclosure: Within 21 days from the end of each quarter, on a quarterly basis.

- Capital Restructuring: Within ten days of any capital restructuring that leads to a change exceeding 2% of the total paid-up share capital.

These provisions ensure that market participants have timely access to the ownership data of listed entities. However, the focus of this discussion lies in the disclosure requirements for entities that belong to the Promoter Group.

Promoter Group and the Disclosure Requirement

Under Regulation 31(4), the regulations stipulate that the entities falling under the Promoter and Promoter Group must be disclosed separately in the shareholding pattern submitted to the stock exchanges.

Who Qualifies as Part of the Promoter Group?

The term "Promoter Group" refers to a set of individuals, entities, or groups that are associated with the promoter of the company in a way that suggests they can influence or control the affairs of the company. This group may include the promoter's relatives, entities controlled by the promoter, and other related persons/entities who are considered part of the promoter’s extended influence network.

Disclosure of Promoter Group Entities

Regulation 31(4) requires that these promoter group entities be disclosed separately in the shareholding pattern. Notably, the regulation does not specify that these entities must hold shares for their disclosure to be required. Therefore, even if a promoter group entity does not own any shares in the company, it must still be disclosed.

The Critical Question: Do Entities Under the Promoter Group Need to Hold Shares to Be Disclosed?

A logical and straightforward interpretation of Regulation 31(4) leads to the conclusion that the Promoter Group entities must be disclosed in the shareholding pattern, irrespective of whether they hold shares. The regulation’s primary concern is to ensure transparency regarding the composition of the promoter group, not necessarily the ownership of securities.

However, it’s essential to ask: Why would we need to disclose entities in the promoter group if they don’t hold any shares?

Logical Interpretation

- Promoter Group Disclosure: The rationale behind disclosing promoter group entities, regardless of whether they hold shares, is rooted in the principle of transparency. Even if these entities do not directly own shares, they may still have a significant influence over the company’s operations, decision-making, or control. Their disclosure provides investors with a clear picture of the entire promoter ecosystem, which can be crucial for assessing governance risks or the potential for influence over company decisions.

- Control and Influence: The promoter group’s composition is important because these entities might indirectly affect the company’s policies or financial performance. For instance, while they might not hold shares at the moment, they could have historical shareholding, reserved rights, or significant influence over corporate decisions. As such, their disclosure is important to understand potential future movements or shifts in power within the company.

- Regulatory Intent: SEBI's focus is on maintaining fairness and ensuring that all relevant parties who may have an impact on corporate governance or decisions are made transparent. Therefore, the emphasis is on identifying who the entities in the promoter group are, not just who holds shares. This could be important for investors who are looking at control structures or understanding possible corporate maneuvers.

Conclusion

Even if entities under the promoter group do not hold shares, they must still be disclosed in the shareholding pattern. This requirement stems directly from Regulation 31(4) and aims to provide complete transparency regarding the composition of the promoter group. The inclusion of such entities in the shareholding pattern allows regulators, investors, and other stakeholders to have a holistic view of the promoter group's influence, even in the absence of direct share ownership.

Therefore, from a regulatory perspective, the focus is not on shareholding but on the need to disclose the promoter group's full structure. It helps create a more comprehensive understanding of the controlling entities behind a listed company, even if these entities are not currently holding any shares.

Disclaimer: The contents of this article are based on current provisions and available information. While every effort has been made to ensure accuracy and reliability, no responsibility is assumed for any errors or omissions. Users are encouraged to refer to applicable laws and regulations. This article is not intended as legal advice, and no liability is accepted for any consequences arising from its use.

From the Desk of CS SHARATH