View News

TRANSFORMATIVE-FUNDING-A-DEEP-DIVE-INTO-CONVERTIBLE-NOTES-FOR-INDIAN-STARTUPS

TRANSFORMATIVE FUNDING: A DEEP DIVE INTO CONVERTIBLE NOTES FOR INDIAN STARTUPS

Introduction:

India's dynamic startup landscape demands innovative financing solutions to propel growth. Convertible notes have emerged as a strategic instrument, offering flexibility and efficiency in capital raising. In this comprehensive article, we explore the regulatory nuances, eligibility criteria, and the advantages of convertible notes, supported by real-world case studies.

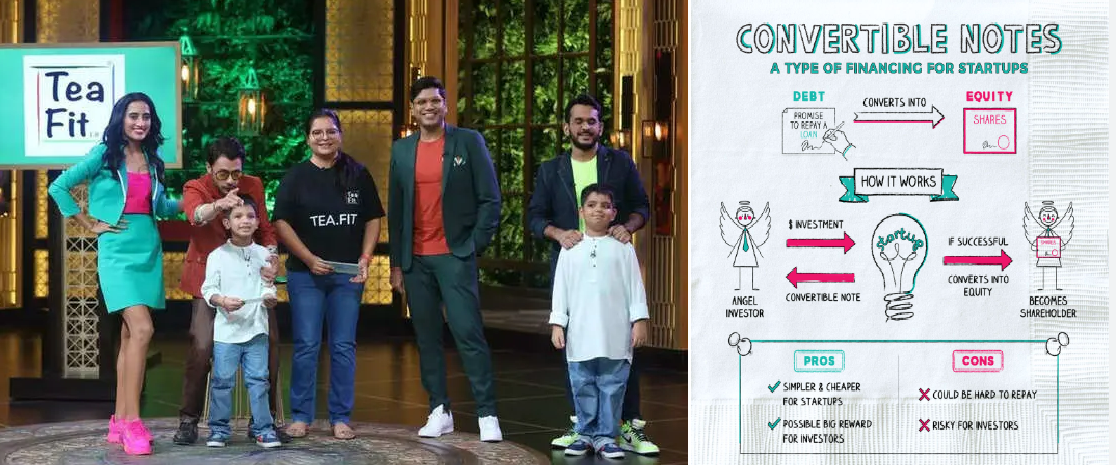

What are Convertible Notes?

Convertible notes act as a bridge between debt and equity financing, allowing startups to secure funds without immediate equity dilution. The Reserve Bank of India (RBI) and the Companies Act have integrated convertible notes into the regulatory framework, simplifying the fundraising process for early-stage companies.

Regulatory Compliance and Procedure:

To issue convertible notes, startups must follow a structured procedure:

1. Board approval and shareholder consent.

2. Drafting and execution of a convertible note agreement.

3. Adherence to RBI guidelines for foreign investments.

4. Annual returns submission for startups with foreign direct investment.

Eligibility Conditions:

Startups eligible for convertible notes must meet specific criteria:

- Incorporation within the last 10 years.

- Turnover below INR 100 crores.

- Engaged in innovative practices, development, or possess scalable business models.

Valuation and Conversion:

Unlike traditional equity investments, convertible notes don't necessitate an initial valuation report. The conversion can be based on a predetermined valuation or the valuation at the time of conversion. Let's delve into some case studies to understand the practical implications of convertible notes.

Case Study 1: Dunzo's Strategic Note Issuance

Dunzo, a hyperlocal delivery startup, opted for convertible notes during its early funding stages. By issuing convertible notes, Dunzo avoided immediate equity valuation, allowing them to secure crucial funds rapidly. As Dunzo achieved key milestones, the notes seamlessly converted into equity, showcasing the success of this financing strategy.

Case Study 2: Udaan's Blend of Convertible Notes and Debt

In 2022, B2B e-commerce giant Udaan raised an impressive $400 million through a combination of convertible notes and debt. This strategic move allowed Udaan to diversify its funding sources, demonstrating the adaptability and effectiveness of convertible notes in complex fundraising scenarios.

Advantages from Investor’s Perspective:

Investors stand to gain several advantages through convertible notes:

- Negotiable valuation caps.

- Interest rates of up to 20%.

- Priority over shareholders in case of liquidation.

Disadvantages from Investor’s Perspective:

While convertible notes offer advantages, investors face certain risks:

- Possibility of financial loss in startup liquidation.

- Uncertainties inherent in early-stage ventures.

- Lack of control as convertible note holders lack voting rights.

Reporting to RBI:

Startups issuing convertible notes to foreign residents must promptly report such inflows to the RBI. Failure to comply within 30 days may result in penalties.

Taxation Aspect:

Tax implications arise post-conversion, with fair market value determining taxable amounts. Startups registered under the Start-up India initiative enjoy exemptions.

Stamp Duty Requirements:

Stamp duty considerations vary across states and should be factored in during convertible note issuance.

Key Terms of Convertible Notes Agreement:

Critical clauses include definitions, investment terms, valuation caps, conversion terms, redemption, termination, and confidentiality.

Conclusion:

Convertible notes offer a transformative financing tool for Indian startups, balancing the interests of entrepreneurs and investors. By navigating the regulatory landscape and leveraging the benefits, startups can secure critical investments for sustained growth.

Key Takeaways:

- Convertible notes provide a safe investment option for early-stage startups.

- Mandatory conversion into shares after five years.

- Investors can earn interest from convertible notes.

- Investment capped at INR 25,00,000.

- Initial-phase investment in convertible notes is advisable for risk mitigation.

|

TEAFIT'S JOURNEY IN SHARK TANK SEASON 2 : NAVIGATING GROWTH WITH CONVERTIBLE NOTES Introduction: TeaFit, founded by Jyoti Bharadwaj in 2021, has become a sensation in the healthy drinks market. This case study delves into TeaFit's impressive journey, highlighting its strategic use of convertible notes during a pivotal moment on Shark Tank India. TeaFit's Background: - Founded in 2021 by Jyoti Bharadwaj. - Specializes in zero-calorie healthy drinks made with natural herbs. - Served over 20,000 customers through online and offline channels. - Initial sales of Rs 15 lakh with a promising trajectory. Shark Tank India Pitch: - Bharadwaj, a mompreneur from Mumbai, impressed Shark Tank India judges with TeaFit's innovative products. - Collective investment of Rs 50 lakh for 8% equity from Vineeta Singh, Peyush Bansal, Anupam Mittal, and Aman Gupta. Bharadwaj's Unique Pitch: - Sharp pitch with minute details about pricing and packaging. - Brought her two young children, aged eight and five, showcasing her dedication. - A fan of Shark Tank US, Bharadwaj shared her gratitude for the national platform to talk about TeaFit. Convertible Note Dynamics: - Initial ask: Rs 50 lakh for 3% equity, valuing the company at Rs 16.67 crore. - Term sheet received: Rs 1 crore, valuing the startup at Rs 20 crore in convertible notes. - Multiple offers made by the sharks, each impacting the startup's valuation. Shark Offers and Valuation: 1. Singh and Mittal: Rs 50 lakh for 25% equity, valuing TeaFit at Rs 2 crore. 2. Bansal: Rs 50 lakh for 20% equity, raising the value to Rs 2.5 crore. 3. Gupta's Offer: Rs 50 lakh for 10% equity, doubling the valuation to Rs 5 crore. 4. Final Offer: Collective investment of Rs 50 lakh for 8% equity, valuing TeaFit at Rs 6.25 crore. Convertible Notes in Action: - Convertible note dynamics showcased in the valuation journey during the pitch. - TeaFit's valuation zooms from Rs 2 crore to Rs 6.25 crore through strategic negotiations. - Aman Gupta's offer plays a crucial role in doubling the valuation. TeaFit's Resilience and Growth: - Despite challenges, TeaFit has thrived, serving over 20,000 customers. - First investment of Rs 10 lakh from Bharadwaj's mother-in-law, Dr Urmila Pandey. - FY22 profit of Rs 78,000 from sales worth Rs 15.5 lakh, with zero advertising spend. Future Projections: - TeaFit forecasts FY23 revenue between Rs 45- Rs 55 lakh based on strong sales in preceding months. - The startup's resilience in overcoming production challenges is commendable. Conclusion: TeaFit's journey exemplifies the strategic use of convertible notes to navigate growth challenges. The collective investment from Shark Tank India judges has not only infused capital but has also elevated the startup's valuation, setting the stage for a promising future. Key Takeaways: - Convertible notes played a pivotal role in TeaFit's valuation journey. - Strategic negotiations on Shark Tank India impacted the startup's trajectory. - Resilience and adaptability are key factors in TeaFit's success. - Collective investment strategy led to an advantageous valuation for both the startup and investors. |

Unlock the Potential of Legal Expertise with LegallMantra.net - Your Trusted Legal Consultancy Partner”

Article Compiled by:-

Mayank Garg

(LegalMantra.net Team)

+91 9582627751

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc.