View News

Setting-Up-a-Wholly-Owned-Subsidiary-A-Comprehensive-Guide

Setting Up a Wholly Owned Subsidiary: A Comprehensive Guide

Introduction

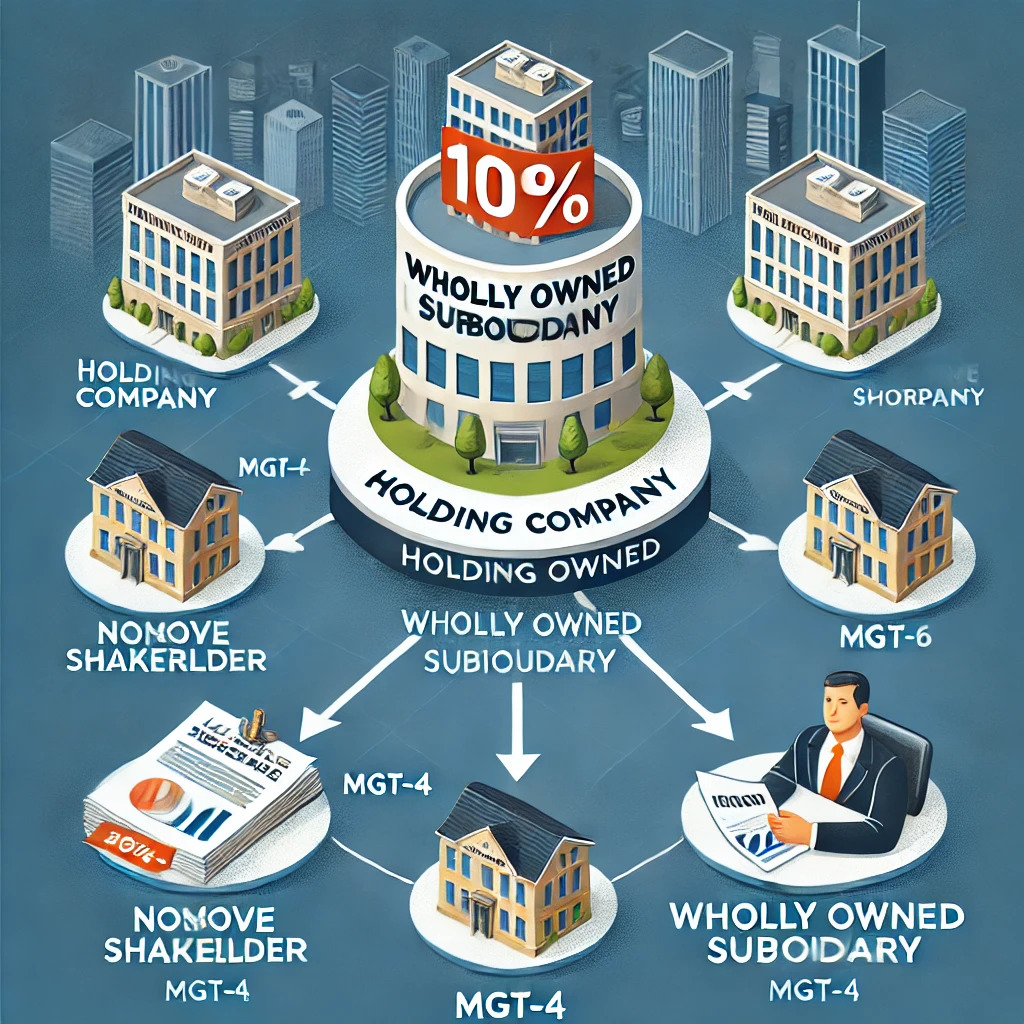

Establishing a Wholly Owned Subsidiary (WOS) is a strategic move often pursued by companies seeking to expand their operations while maintaining complete control. However, a common challenge arises from the statutory requirement that mandates a minimum number of members for private and public companies. This creates uncertainty regarding how a holding company can own 100% of the share capital. Fortunately, Section 89 of the Companies Act, 2013, offers a solution through the concept of registered and beneficial ownership.

Understanding Registered and Beneficial Ownership

A registered owner is the individual or entity whose name is officially entered into the Register of Members (ROM) as a shareholder. However, this person does not receive any benefits from the share. On the other hand, a beneficial owner is the person or entity that enjoys the economic benefits of the share, even though their name is not recorded in the ROM.

Practical Example

Consider X Private Limited, a wholly owned subsidiary of Y Private Limited with a share capital of Rs 1,00,000 (Face value - Rs 1 per share). In the ROM of X Private Limited, Y Private Limited holds 99,999 shares, and a nominee, referred to as A, holds 1 share on behalf of Y Private Limited. In this scenario, A is the registered owner of the 1 share, but does not derive any benefit from it. Y Private Limited is the beneficial owner of the share. This arrangement ensures that X Private Limited qualifies as a wholly owned subsidiary of Y Private Limited.

Public Company Scenario

For a public wholly owned subsidiary, the legal requirement for a minimum of seven members can be satisfied by having one holding company as the beneficial owner and six individuals as nominees acting as registered owners. This allows the parent company to maintain 100% control while complying with statutory regulations.

Essential Filings for Wholly Owned Subsidiary Status

To formalize the status of a wholly owned subsidiary, the following filings are mandatory under Section 89 of the Companies Act, 2013:

-

MGT-4: Declaration by the registered owner specifying that they hold the shares on behalf of the beneficial owner.

-

MGT-5: Declaration by the beneficial owner confirming their beneficial interest in the shares.

-

MGT-6: Return to the Registrar of Companies (ROC) intimating the declarations received under Section 89.

Conclusion

Setting up a wholly owned subsidiary is an effective way for companies to expand their business operations while retaining full control. The nominee shareholding mechanism under Section 89 ensures that statutory requirements are met without compromising the holding company's complete ownership. By adhering to the necessary legal procedures and filings, companies can seamlessly establish and manage wholly owned subsidiaries, fostering growth and operational efficiency.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc.

CS J SWARNALAKSHMI