View News

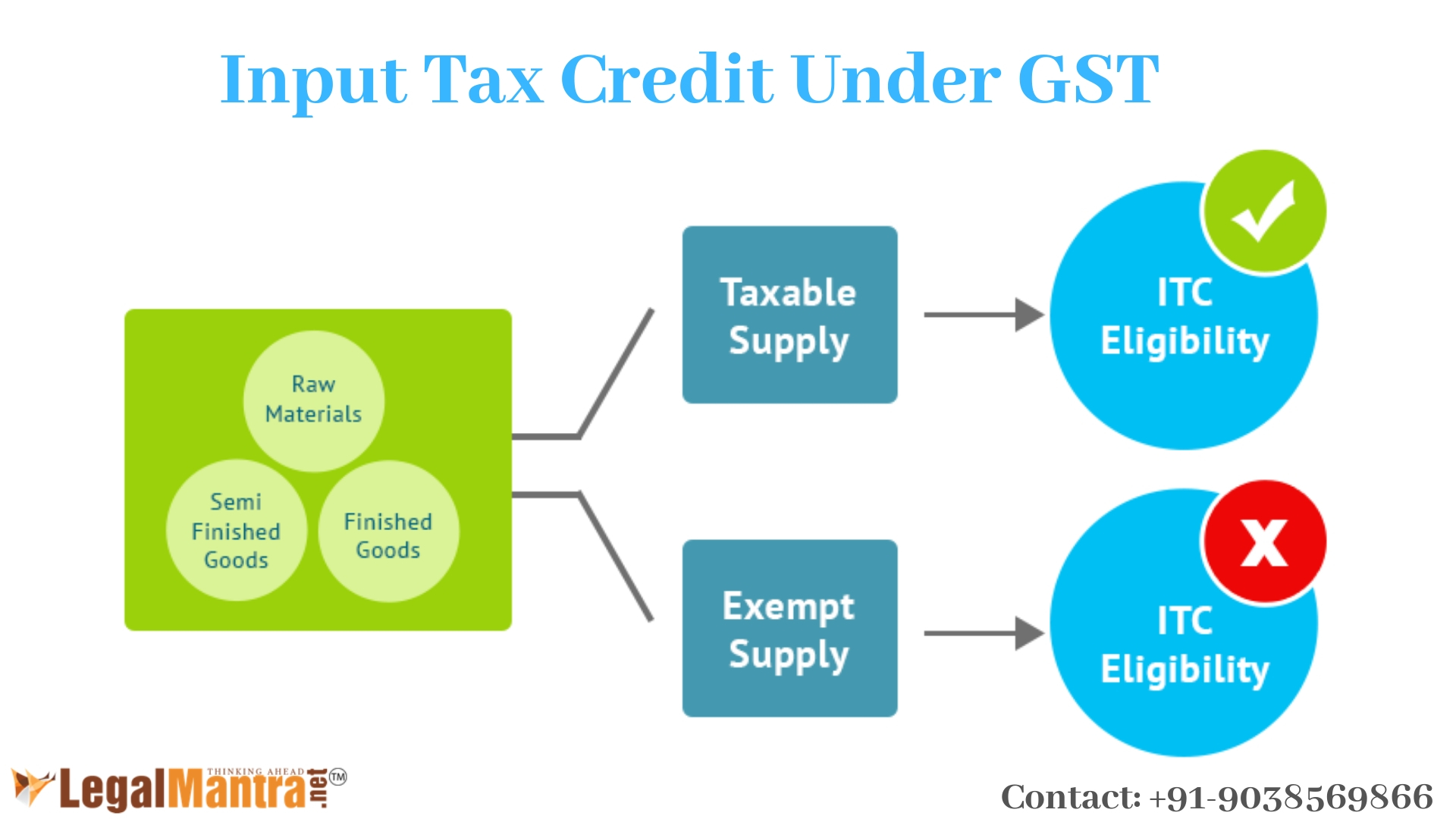

An Interesting Issue in GST: Availability of Input Tax Credit (ITC) on capital goods and input services if used for supply of both taxable and exempted goods

COMPLETE ORDER OF AAR, WEST BENGAL

- Admissibility of the Application

1.1 The Applicant has set up a manufacturing facility for UHT milk, milkshake, curd and lassi. Some of the goods are taxable, and others exempted under the GST Act. Commercial production of UHT milk has been going on since December 2018. Manufacture of other products is likely to begin soon. The Applicant has procured capital goods and input services that are common to the production of both taxable and exempted goods. The Applicant wants to know to what extent and in what proportion the input tax credit is admissible on such capital goods and input services. An advance ruling is acceptable on this question under section 97(2)(d) of the GST Act.

1.2 The applicant also declares that the issues raised in the application are not pending nor decided in any proceedings under any provisions of the GST Act. The officer concerned from the Revenue has not objected to the admission of the Application.

1.3 The Application is, therefore, admitted.

- Submissions of the applicant

2.1 The applicant submits that the apportionment of input tax credit should be based on the provisions under section 17(2) & (3) of the GST Act read with rules 42 and 43 of the CGST Rules 2017 and WBSGST Rules 2017 (hereinafter GST Rules). The input tax credit is, therefore, restricted to the credit attributable to taxable supplies. How to determine such an amount is prescribed in rule 43. The useful life of capital goods is taken as five years from the date of invoice under rule 43(1)(c) of the GST Rules. The applicant submits that the formula prescribed under rule 43 of the GST Rules is applicable only after the commencement of commercial production. The useful life of the capital goods should, therefore, be calculated from the date of the beginning of the commercial production.

2.2 Furthermore, rule 42 prescribes the manner of determination of input tax credit on input services and reversal thereof in cases like that of the applicant. In terms of rule 42(1)(i) of the GST Rules, the amount of input tax credit attributable to exempt supplies shall be computed every month. After that, the input tax credit for the financial year shall be finally calculated in terms of rule 42(2) of the GST Rules before the due date for furnishing return for the month of September following the end of the financial year to which such credit relates.

2.3 In the applicant’s case, the commercial production of taxable goods started in December 2018. The commercial production of the exempt goods did not begin in 2018-19. The applicant should, therefore, be eligible for credit of the entire input tax on input services.

- Submission of the Revenue

3.1 The concerned officer from the Revenue submits that apportionment of the input tax credit on the capital goods used for manufacture of both the taxable and the exempted goods should be made in the manner prescribed under proviso to rule 43(1)(d) of the GST Rules and other related clauses of rule 43(1). The applicant purchased capital goods that were used for producing taxable goods UHT milk. On a subsequent date, the same capital goods are going to be used for manufacturing both taxable and non-taxable goods. The amount of input tax on each of such capital goods is denoted by ‘A’ and shall be credited to the electronic credit ledger in terms of rule 43(1)(c) of the GST Rules. The value of ‘A’ is arrived at by reducing the input tax at 5% rate for every quarter or part thereof. In other words, input tax on such capital goods as were initially used for producing taxable goods only, but subsequently used for manufacturing both taxable and exempted goods, are to be attributed at 5% rate for every quarter or part thereof to production of taxable goods during the period when they were used for production of taxable goods only. The balance amount, if any, available when the production of exempted goods begins, will be the amount ‘A’. The aggregate of the amounts of ‘A’ are added to the corpus of input tax called ‘Tc’ for apportionment in accordance with rule 43(1)(e), (f) & (g) of the GST Rules.

3.2 The concerned officer from the Revenue further submits that input tax credit on input services should be apportioned in the manner prescribed under rule 42 of the GST Rules. The applicant is eligible for credit of the entire input tax on input services till the production of exempted goods begins.

- Observations and Findings of the Authority

4.1 This Authority agrees with the concerned officer from the Revenue on the mechanism for apportionment of input tax credit on capital goods that were used for manufacturing taxable goods but are going to be used subsequently for production of both taxable and exempted goods. The amount of input tax on each of such capital goods shall be credited to the electronic credit ledger in terms of rule 43(1)(c) of the GST Rules, which also prescribes sixty months from the date of invoice as the useful life of such capital goods. Rule 43(1) provides the mechanism for apportionment of the input tax available in the corpus Tc over the balance period of the useful life.

4.2 The applicant is required to furnish the details of inward supply of goods or services, including that of capital goods, received during a tax period in GSTR-2 and GSTR-3B. As soon as such reporting is made, the input tax is credited to the electronic credit ledger. When the production of taxable goods commenced in December 2018, the applicant enjoyed the credit the of entire input tax in terms of rule 43(1)(b) of the GST Rules. Subsequently, the same capital goods are being used for manufacturing exempted goods also. The question, therefore, arises how much of the input tax credit should be attributed to the period when such capital goods were used for manufacturing taxable goods, and how the balance amount of the input tax should be apportioned after production of the exempted goods commences. The Proviso to rule 43(1)(d) of the GST Rules answers the first question, and prescriptions under Rule 43(1)(e), (f) and (g) of the GST Rules answer the second question. Based on such prescriptions, the applicant is required to compute the admissible amount of the input tax credit on such capital goods in the tax periods over the useful life calculated from the date of invoice and reverse the balance amount.

4.3 The manner of apportioning the common credit of input tax [denoted by ‘CI‘ in rule 42(1)(h)] is prescribed under rule 42(1)(1), (j), (k), (I) and (m) of the GST Rules. The amount of the common credit attributable towards exempt supplies (Di) is to be determined as below:

Di=(E/F)*C2

where ‘E’ is the aggregate value of exempt supplies and ‘F’ is the total turnover in the State during the tax period.

4.4 In the applicant’s case, the commercial production of taxable goods started in December 2018. The commercial production of the exempt goods did not begin in 2018-19. The value of D1, therefore, is zero during the tax periods in 2018-19. No amount of the common credit of input tax on input services available during 2018-19 should, therefore, be attributed towards exempt supplies. In other words, subject to the provisions under rule 42(2) of the GST Rules, the entire input tax on input services is an admissible credit during 2018-19.

4.5 It is presumed that the applicant does not make any exempt supplies other than the ones it manufactures.

In view of the foregoing, we rule as under

RULING

Based on the proviso to rule 43(1)(d) of the GST Rules and further prescriptions under rule 43(1)(e), (f) and (g) of the GST Rules, the applicant is required to compute the admissible amount of the input tax credit on the capital goods used for both taxable and exempt supplies in the tax periods over the useful life of such capital goods, calculated from the date of invoice. The applicant shall reverse the balance amount of the input tax on the said capital goods that has already been credited to its electronic credit ledger.

As the commercial production of exempted goods did not begin in 2018-19, the entire input tax on input services, subject to the provisions under rule 42(2) of the GST Rules, is an admissible credit during 2018-19.

This Ruling is valid subject to the provisions under Section 103 until and unless declared void under Section 104(1) of the GST Act.