View News

BOOSTING-INDIA-EXPORT-COMPETITIVENESS-THE-EXPANDED-RoDTEP-SCHEME

BOOSTING INDIA'S EXPORT COMPETITIVENESS: THE EXPANDED RoDTEP SCHEME

INTRODUCTION:

In a significant move aimed at bolstering India's exports and enhancing its global competitiveness, the Indian government, led by Commerce and Industry Minister, has announced a substantial expansion of the Remission of Duties and Taxes on Exported Products (RoDTEP) Scheme. This expansion, unveiled on March 8, 2024, encompasses Special Economic Zones (SEZs), Export Oriented Units (EOUs), and entities utilizing the Advance Authorisation (AA) scheme, marking a crucial milestone in India's export policy framework.

BACKGROUND OF THE RODTEP SCHEME:

The RoDTEP scheme, introduced on January 1, 2021, serves as a pivotal mechanism to provide duty refunds on exported products, thereby incentivizing exports and fostering economic growth. It was crafted in response to global dynamics, including the World Trade Organization (WTO) ruling against India's earlier export subsidy schemes. By aligning with global principles and ensuring compliance with WTO regulations, RoDTEP aims to promote fair trade practices while supporting India's export-oriented industries.

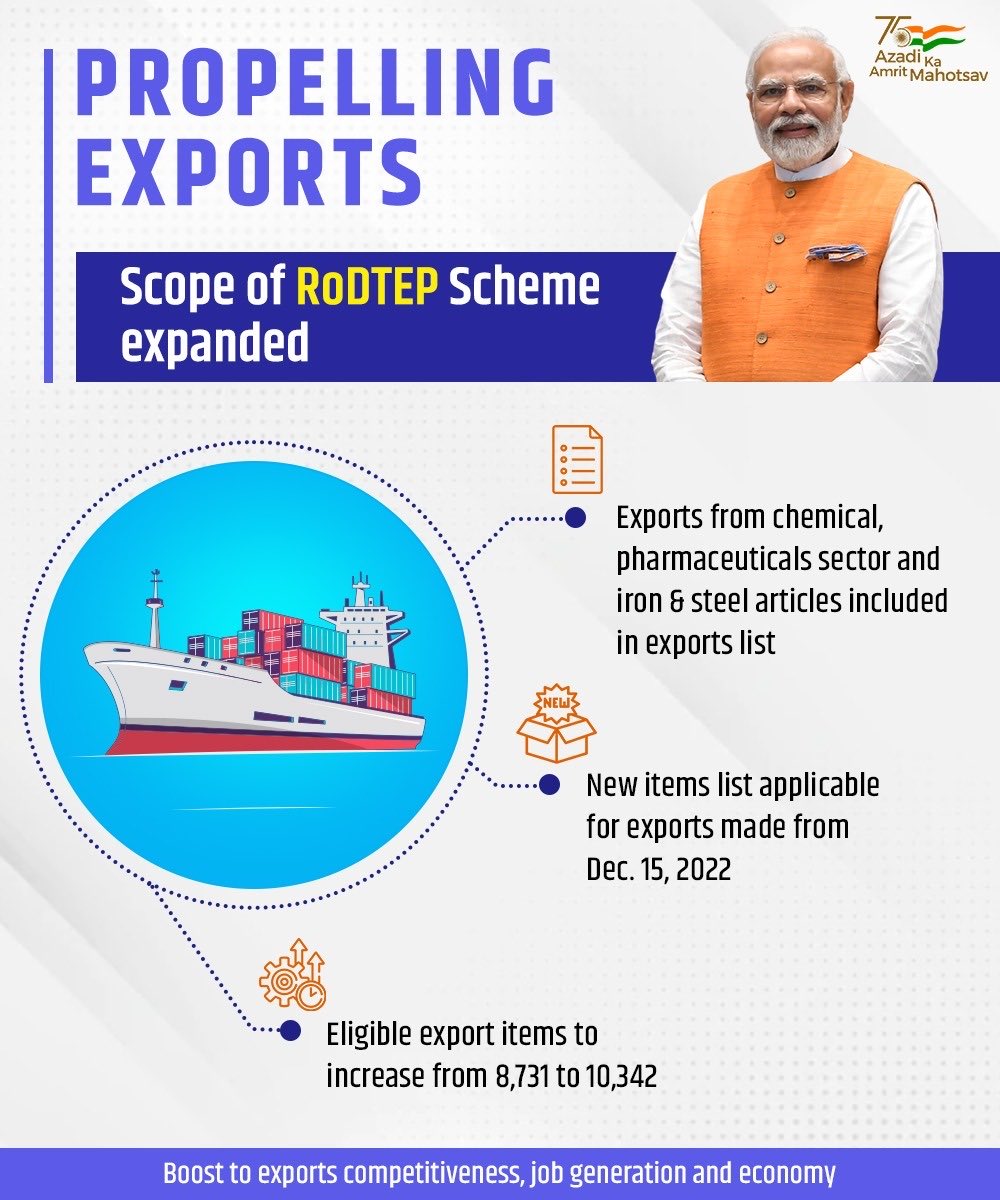

SCOPE OF THE EXPANSION:

The recent expansion of the RoDTEP Scheme entails the inclusion of SEZs, EOUs, and AA holders, representing significant segments of India's export landscape. This expansion acknowledges the pivotal role played by these entities, collectively contributing approximately 25% of India's total exports. By extending RoDTEP benefits to previously uncovered sectors, the government aims to fortify the resilience of the exporting community against international headwinds, particularly amidst economic uncertainties and supply chain disruptions.

IMPLEMENTATION TIMELINE AND BUDGETARY ALLOCATIONS:

The benefits under the expanded RoDTEP Scheme for EOUs and AA holders commenced from March 11, 2024, signifying a proactive approach towards supporting export-oriented entities. However, the integration of SEZs with the automated ICEGATE system of the Customs section is awaited, with benefits expected to be operational until September 30, 2024. In terms of budgetary allocations, the RoDTEP Scheme has a budget of ?15,070 crores for the fiscal year 2024-25, with provisions for additional increments, reflecting the government's commitment to facilitating exports.

SIGNIFICANCE AND INDUSTRY IMPACT:

The extension of the RoDTEP Scheme holds immense significance for key sectors such as Engineering, Textiles, Chemicals, Pharmaceuticals, and Food Processing. These sectors are poised to benefit from the scheme's incentives, which not only enhance their competitiveness in global markets but also contribute to employment generation and economic growth. By recognizing the vital contribution of SEZs, EOUs, and AA holders, the government underscores its commitment to nurturing industries pivotal for India's export-driven growth trajectory.

RoDTEP RATES AND REFUNDS:

Under the RoDTEP scheme, exporters are entitled to refunds of various central and state duties, taxes, and levies incurred during the manufacturing and distribution of exported products. The scheme's rates range from 0.3% to 4.3%, depending on the specific product categories. By refunding taxes and duties not covered under other schemes, RoDTEP alleviates the financial burden on exporters, thereby fostering a conducive environment for export-led growth.

GOVERNMENT'S VISION AND FUTURE PROSPECTS:

The government's proactive measures, including the extension of the RoDTEP scheme and efforts to negotiate new Free Trade Agreements (FTAs), underscore its commitment to accelerating India's journey towards achieving USD 1 trillion in merchandise exports. By facilitating a conducive ecosystem for exports, the government aims to strengthen India's position in the global market, enhance its export competitiveness, and foster sustained economic development. The expansion of the RoDTEP scheme serves as a pivotal step in this direction, reflecting the government's unwavering resolve to support and promote India's export-oriented industries.

CONCLUSION:

In conclusion, the expanded RoDTEP Scheme represents a watershed moment in India's export policy landscape, underscoring the government's proactive approach towards fostering export-led growth. By extending benefits to previously uncovered sectors and aligning with global trade norms, the scheme aims to bolster India's export competitiveness, promote inclusive growth, and propel the nation towards economic prosperity. As India embarks on its journey to emerge as a global export powerhouse, the RoDTEP scheme stands as a testament to the government's commitment to building an Aatmanirbhar Bharat and realizing the nation's true export potential.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Article Compiled by:-

Mayank Garg

(LegalMantra.net Team)

+91 9582627751

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc.