View News

Are-You-Really-Benefitting-from-the-Latest-RBI-Repo-Rate-Cuts

Are You Really Benefitting from the Latest RBI Repo Rate Cuts?

-Expert Insights by CA Aayush Garg

Introduction

CA Aayush Garg, a senior Chartered Accountant, qualified Company Secretary (CS), and Cost and Management Accountant (CMA), is also a Gold Medalist with deep expertise in finance and taxation. His views are particularly relevant at a time when the Reserve Bank of India (RBI) has once again slashed the repo rate in an attempt to stimulate the economy.

Understanding the Recent Repo Rate Cuts

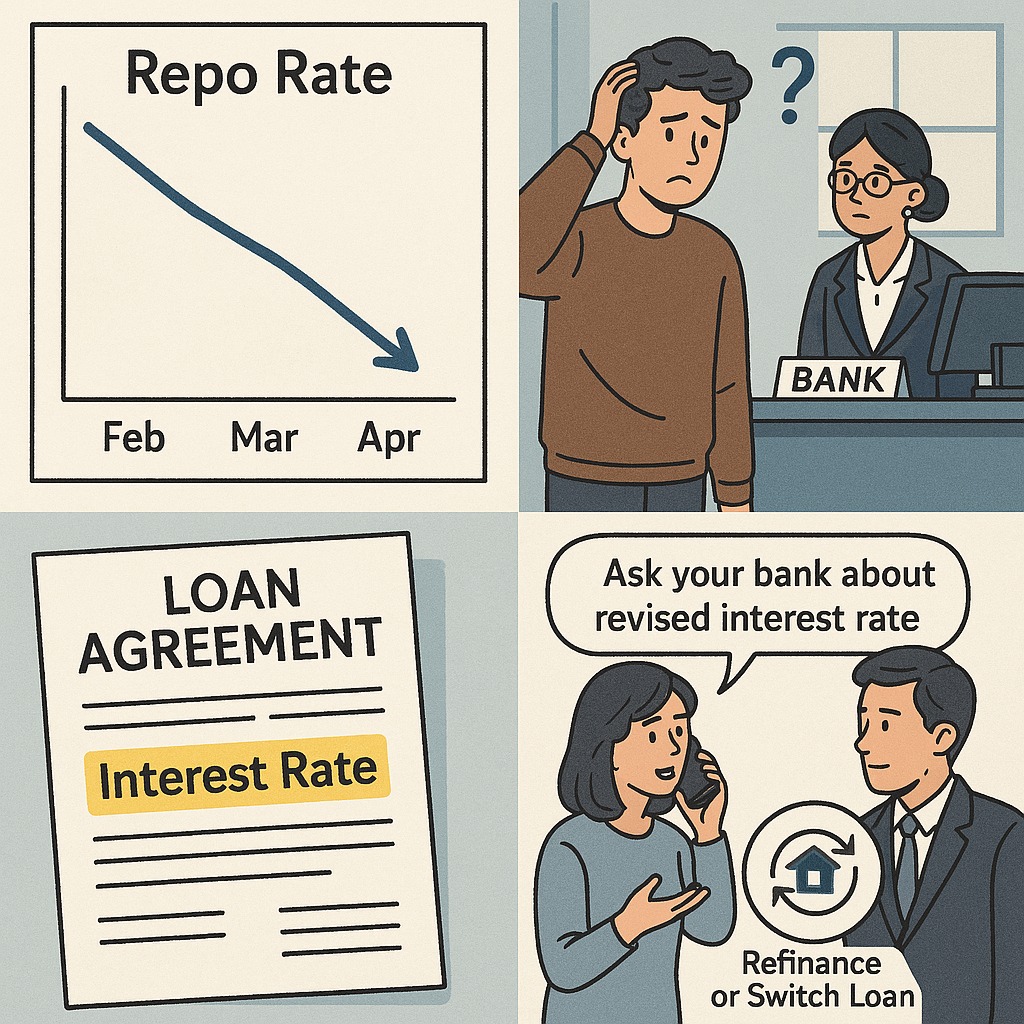

On April 9, 2025, the Reserve Bank of India reduced the repo rate by 25 basis points, lowering it from 6.25% to 6.00%. This follows an earlier cut of 25 basis points on February 7, 2025, making it the second consecutive rate cutthis year.

The repo rate—the rate at which RBI lends money to commercial banks—is a key tool in controlling inflation and stimulating growth. A lower repo rate encourages banks to reduce their lending rates, ideally making loans cheaper for consumers and businesses.

The Critical Question: Are Borrowers Actually Benefiting?

While the RBI’s move is aimed at boosting economic activity, CA Aayush Garg poses an important question:

“Are existing loan borrowers truly benefitting from this rate cut?”

In many cases, the answer is not as straightforward as one might assume. Though lower repo rates should ideally reduce EMIs (Equated Monthly Installments), the benefit does not always automatically reach all borrowers—especially existing ones.

Why Many Existing Borrowers May Miss Out

It has been frequently observed that banks—particularly private sector banks—are quick to offer new loans at reduced rates to attract fresh customers, but they are slower to pass on the benefit to their existing borrowers. If your loan is not linked to the repo rate, there is a high chance that you’re still paying interest based on older, higher rates.

What Should Existing Loan Borrowers Do?

CA Aayush Garg recommends that borrowers take a proactive approach. Here’s a structured guide:

-

Check Your Loan Agreement

-

Determine whether your loan is fixed-rate, MCLR-based, or repo rate-linked.

-

Repo rate-linked loans adjust faster to RBI’s rate changes compared to MCLR or fixed-rate loans.

-

-

Speak to Your Bank

-

Contact your bank and ask whether the new repo rate cut has been passed on to your loan.

-

Don’t assume your EMI has automatically been reduced.

-

-

Request for Interest Rate Revision

-

If the benefit hasn’t been passed on, formally request a revision of your interest rate.

-

Some banks may require a nominal processing fee for shifting your loan to a lower rate regime.

-

-

Consider Refinancing

-

If your current bank is unwilling to offer better terms, explore loan transfer options to other banks or NBFCs offering lower interest rates.

-

Make sure to evaluate prepayment charges, processing fees, and overall cost-benefit before switching.

-

Why Banks Behave This Way

Banks often revise interest rates for new customers more quickly than for existing ones because it's a strategy to attract new business. For existing customers, unless they initiate the conversation or request, banks may not voluntarily revise the loan terms.

This disparity means that staying passive may result in paying higher EMIs—even when better rates are available in the market.

Final Thoughts by CA Aayush Garg

“If you are repaying a loan, do not assume that your EMI has gone down just because the RBI has cut the repo rate. Talk to your bank, compare interest rates across lenders, and ensure you are not overpaying.”

In conclusion:

-

Do not wait passively.

-

Inquire. Confirm. Act.

-

Ensuring that you are benefitting from repo rate cuts could save you thousands—if not lakhs—over the life of your loan.

Stay informed. Stay empowered.

Because when it comes to your finances, silence can be expensive.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc.