View News

56th GST Council Meeting: A Landmark in Simplifying GST

56th GST Council Meeting: A Landmark in Simplifying GST

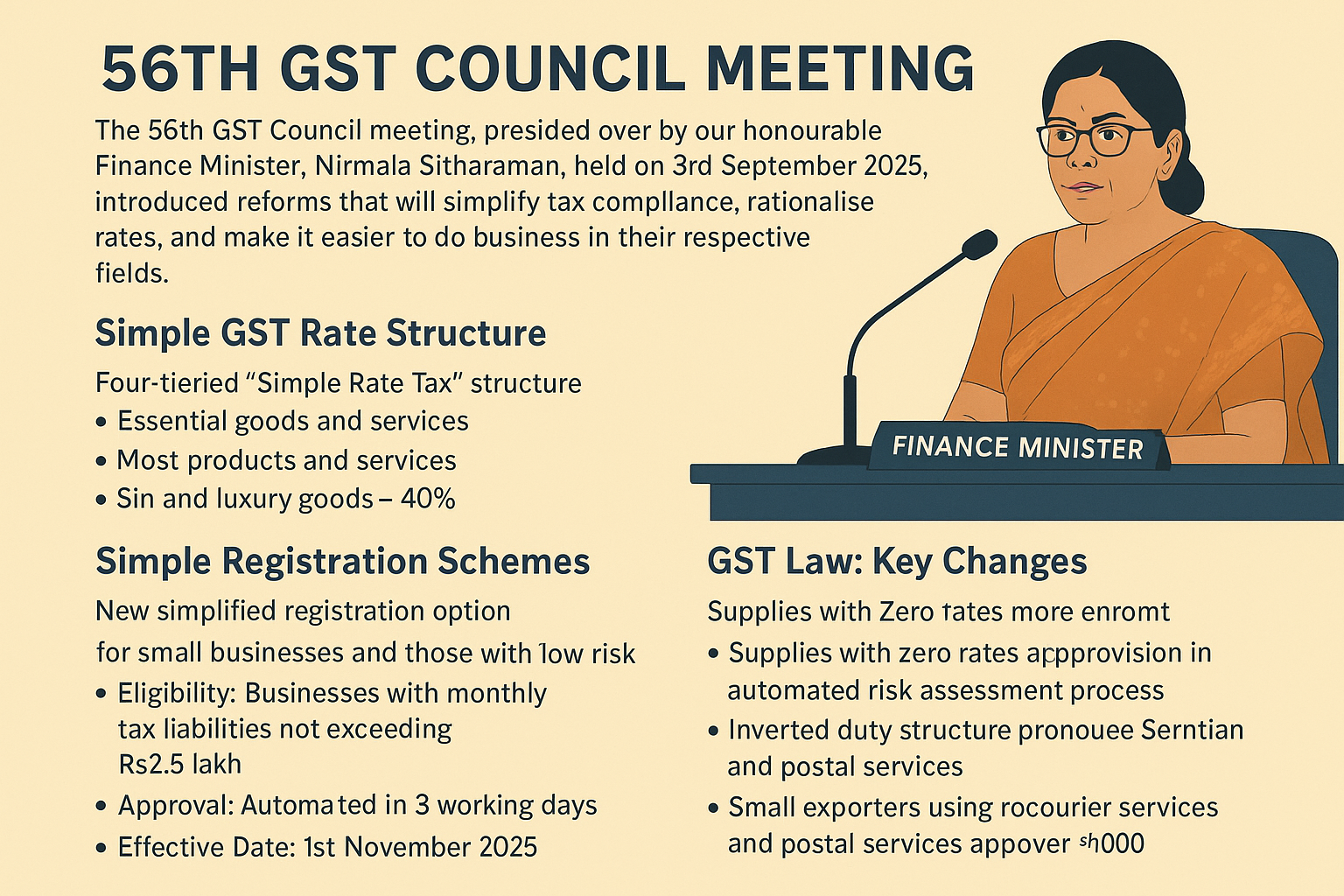

The 56th GST Council Meeting, chaired by Hon’ble Finance Minister Smt. Nirmala Sitharaman, convened on 3rd September 2025, has been described as one of the most reform-oriented council meetings since the introduction of GST in July 2017. It unveiled a series of structural, procedural, and substantive reforms aimed at simplifying India’s Goods and Services Tax framework, rationalizing rates, reducing compliance burden, and making India’s tax system more globally competitive. These reforms are expected to bring long-term relief to small businesses, exporters, consumers, and the broader economy.

A New, Simplified GST Rate Structure

One of the most significant announcements was the rationalization of GST rates into a three-tier framework, replacing the previously complicated multi-rate system:

-

5% (Merit Rate): For essential goods and services such as basic food items, medicines, and education-related services.

-

18% (Standard Rate): For most goods and services, covering the broad consumer and industrial sectors.

-

40% (De-Merit Rate): For luxury and sin goods, including tobacco, alcohol substitutes, and luxury automobiles.

Why it matters:

This move eliminates ambiguities and reduces frequent disputes on classification. Businesses will spend less time on litigation and more on growth. Consumers will find GST easier to understand, improving tax transparency.

Hassle-Free GST Registration for Small Businesses

To encourage voluntary compliance and support the MSME sector, the Council introduced a Simplified Registration Scheme, effective 1st November 2025.

Key features:

-

Eligibility: Businesses with monthly GST liability not exceeding ?2.5 lakh.

-

Approval: Fully automated, with approval within three working days.

-

Flexibility: Businesses can opt in or out voluntarily without penalty.

-

E-commerce Sellers: Relief from the requirement of maintaining a primary place of business in every state, allowing easier pan-India selling.

Why it matters:

This encourages micro-entrepreneurs and startups to enter the formal system and reduces bureaucratic bottlenecks, supporting the ease of doing business.

Legal Simplifications in GST Law

Several amendments and clarifications have been introduced:

-

Section 13(8)(b) of IGST Act Omitted: This section earlier deemed the place of supply for intermediaries as India, creating a tax burden. Now, the place of supply will be where the recipient is located, enabling Indian service providers to claim export benefits.

-

Post-Sale Discounts Simplified: No longer mandatory to have pre-agreed discount clauses on invoices. Adjustments can now be made through credit notes with ITC reversal.

-

Clarificatory Circular on Discounts: To guide on dealer incentives, promotional schemes, and ITC reversals, reducing scope for misinterpretation.

Why it matters:

These reforms boost competitiveness of Indian service exports, bring legal clarity for trade and industry, and reduce disputes with tax authorities.

GST Appellate Tribunal (GSTAT) – Operational Roadmap

The long-pending GST Appellate Tribunal (GSTAT) is set to become functional by December 2025.

-

Jurisdiction: Will hear second-level appeals and reduce the burden on High Courts.

-

Backlog Filing Deadline: Taxpayers must file pending appeals by 30th June 2026.

-

Principal Bench: The National Appellate Authority for Advance Ruling will act as the central authority.

Why it matters:

Businesses will get access to timely justice and specialized forums for GST disputes. This reduces delays and improves trust in tax governance.

Refund Reforms: Faster, Smoother, Simpler

Refunds have been one of the biggest pain points in GST. The Council addressed this by approving provisional, automated refund mechanisms:

-

Zero-rated Supplies: 90% of refund claims to be provisionally sanctioned from 1st November 2025, based on automated risk assessment.

-

Inverted Duty Structure (IDS): Similar provisional refunds (90%) extended to cases where input tax exceeds output tax.

-

Exports of Low-Value Goods: Exporters using courier and postal services can now claim refunds on consignments valued below ?1000.

Why it matters:

This improves liquidity for exporters, especially MSMEs. It reduces cash flow constraints and working capital blockages, enhancing India’s export competitiveness.

Revised GST Rates on Services (Effective 22nd Sept 2025)

The Council approved significant rate revisions in service sectors:

-

Goods Transport Agency (GTA): Increased from 12% to 18% (with ITC).

-

Multimodal Transport: Either 5% (with ITC restrictions) or 18% (with ITC).

-

Passenger Car Rentals: Increased from 12% to 18% (with ITC).

-

Goods Transport Rentals: 5% with ITC restrictions.

-

Job Work Services: Increased from 12% to 18% (with ITC).

-

Life and Health Insurance: Exempted from GST.

Why it matters:

While rate increases may raise costs in logistics and job work sectors, the exemption of health and life insurance encourages wider adoption, supporting public welfare.

Key Implementation Clarifications

-

Effective Date for Rate Changes: 22nd September 2025.

-

E-way Bills: No requirement to regenerate for goods already in transit.

-

IDS Refunds: Only applicable when input tax is higher than output tax, not merely due to rate revisions.

Conclusion: GST’s Next Phase of Evolution

The 56th GST Council Meeting is being hailed as a watershed moment in India’s tax reform journey. The decisions taken balance the twin goals of simplifying compliance and ensuring revenue neutrality, while keeping taxpayer convenience in mind.

Key Takeaways:

-

Simplified three-rate GST structure.

-

Pro-business registration scheme for small taxpayers.

-

Faster and automated refunds to ease liquidity stress.

-

Legal clarity on discounts and export benefits.

-

Operational GSTAT to resolve disputes quickly.

-

Relief to consumers through exemption of essential insurance services.

Businesses and professionals should revisit compliance strategies, pricing models, and contracts in light of these reforms, and proactively prepare for the implementation timelines.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc

Anshul Goel (LegalMantra.net)